Blank 3015 1 Minnesota Template

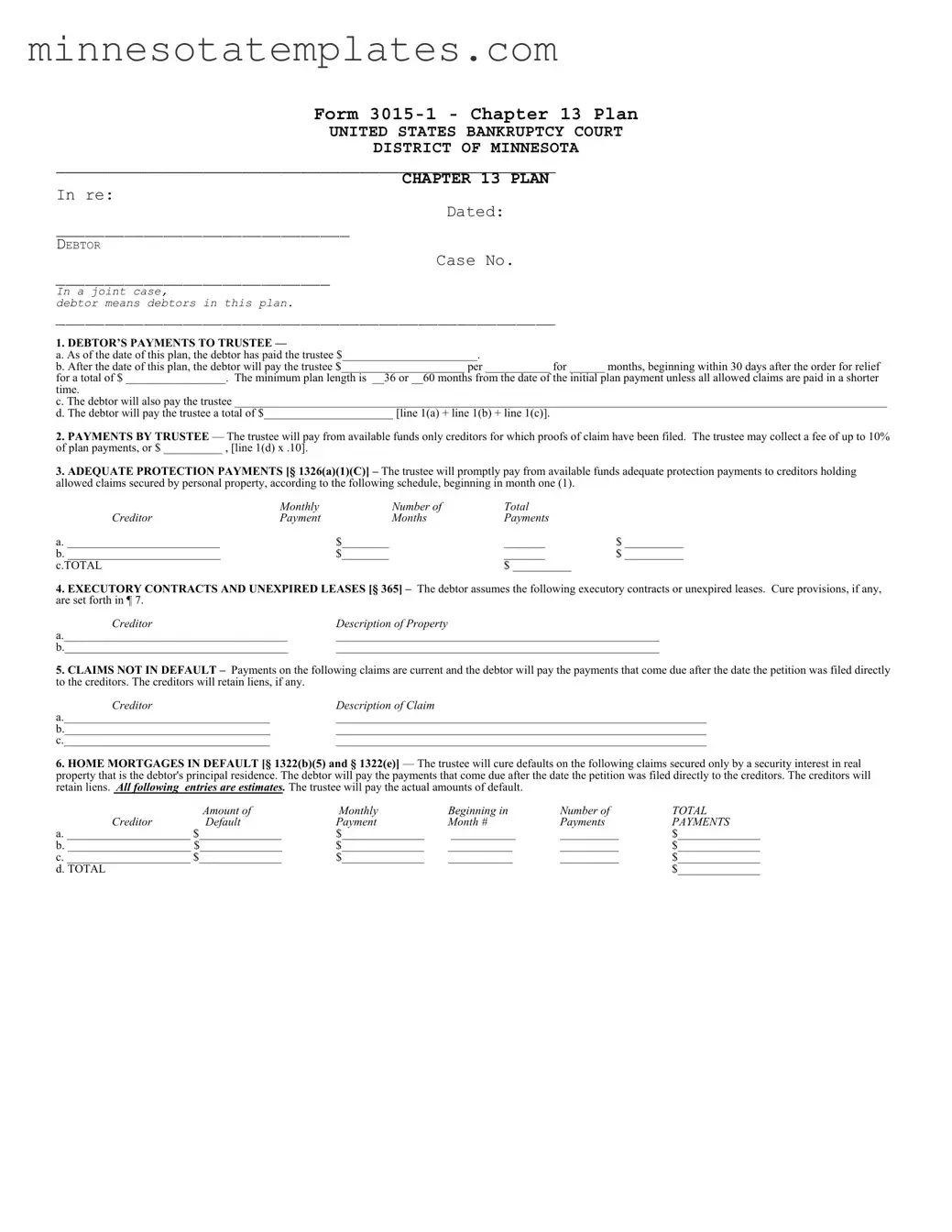

The 3015-1 Minnesota form, specifically designed for Chapter 13 bankruptcy plans, serves as a crucial document for debtors navigating the complexities of financial rehabilitation. This form outlines the debtor's commitments to repay creditors over a specified period, typically ranging from 36 to 60 months. It details the payments the debtor will make to the trustee, including any additional amounts necessary to address secured claims, priority claims, and other obligations. The form also specifies how the trustee will distribute funds to creditors, ensuring that all allowed claims are addressed according to legal requirements. Additionally, it includes provisions for curing defaults on home mortgages and other secured debts, while allowing debtors to maintain certain executory contracts and leases. By providing a comprehensive overview of the debtor's financial commitments and the trustee's role, the 3015-1 form facilitates a structured approach to debt repayment, ultimately aiming to restore the debtor's financial stability.

Key takeaways

Here are some key takeaways for filling out and using the 3015-1 Minnesota form:

- Accurate Information: Ensure all information is accurate and complete. This includes personal details, case number, and payment amounts.

- Payment Structure: Clearly outline the payment plan to the trustee, including amounts and frequency. Specify the total payments expected over the plan's duration.

- Trustee's Role: Understand that the trustee will only pay creditors with filed proofs of claim. Payments to the trustee may include a fee of up to 10% of plan payments.

- Claims Management: List all claims, including those in default and those that are current. This helps in managing obligations effectively.

- Home Mortgages: If there are defaults on home mortgages, detail the repayment plan for curing those defaults. Payments should be directed to creditors post-petition filing.

- Priority Claims: Identify and estimate priority claims that must be paid in full. This includes debts like attorney fees and domestic support obligations.

- Unsecured Creditors: Separate classes of unsecured creditors may exist. Clearly define these classes and their estimated claims.

- Timely Filing: Ensure all claims are filed in a timely manner. This affects how payments are distributed by the trustee.

- Final Review: Before submitting, review the entire form for accuracy. The total at the end must match the total of all payments outlined.

Misconceptions

Understanding the 3015 1 Minnesota form can be crucial for those navigating Chapter 13 bankruptcy. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: The form is only for individuals with significant debt.

- Misconception 2: Once the form is filed, the debtor cannot make changes.

- Misconception 3: The trustee pays all creditors immediately after the form is submitted.

- Misconception 4: Filing the form guarantees debt discharge.

This is not true. The 3015 1 form is designed for individuals seeking to reorganize their debts, regardless of the total amount. It is suitable for anyone looking to manage their financial obligations through a structured repayment plan.

In reality, debtors can modify their plans even after filing. Changes may be necessary due to fluctuations in income or expenses. However, these modifications must be approved by the court.

This is misleading. The trustee pays creditors from the funds collected according to the repayment schedule outlined in the plan. Payments are made over time, based on the debtor's ability to pay.

Filing the 3015 1 form does not automatically lead to debt discharge. The court must confirm the repayment plan, and the debtor must adhere to its terms for a successful discharge of eligible debts.

Additional PDF Templates

Minnesota Tax Form - The calculations on the M30 must include any penalties and interest as instructed in the guidelines.

For those looking to complete a vehicle transaction in Alabama, the comprehensive Motor Vehicle Bill of Sale must be correctly filled out, serving as an essential part of the sales process. This document not only confirms the exchange but also provides legal backing for the sale. For more information on how to properly use this form, refer to the official guide on the Motor Vehicle Bill of Sale.

Minnesota Urolith Center Login - Identifying which prescription diet was fed aids in understanding treatment efficacy and compliance.

Mn Credentialing Collaborative - The application includes sections for chronological employment history, including military service.