Blank Affidavit Of Repossession Minnesota Template

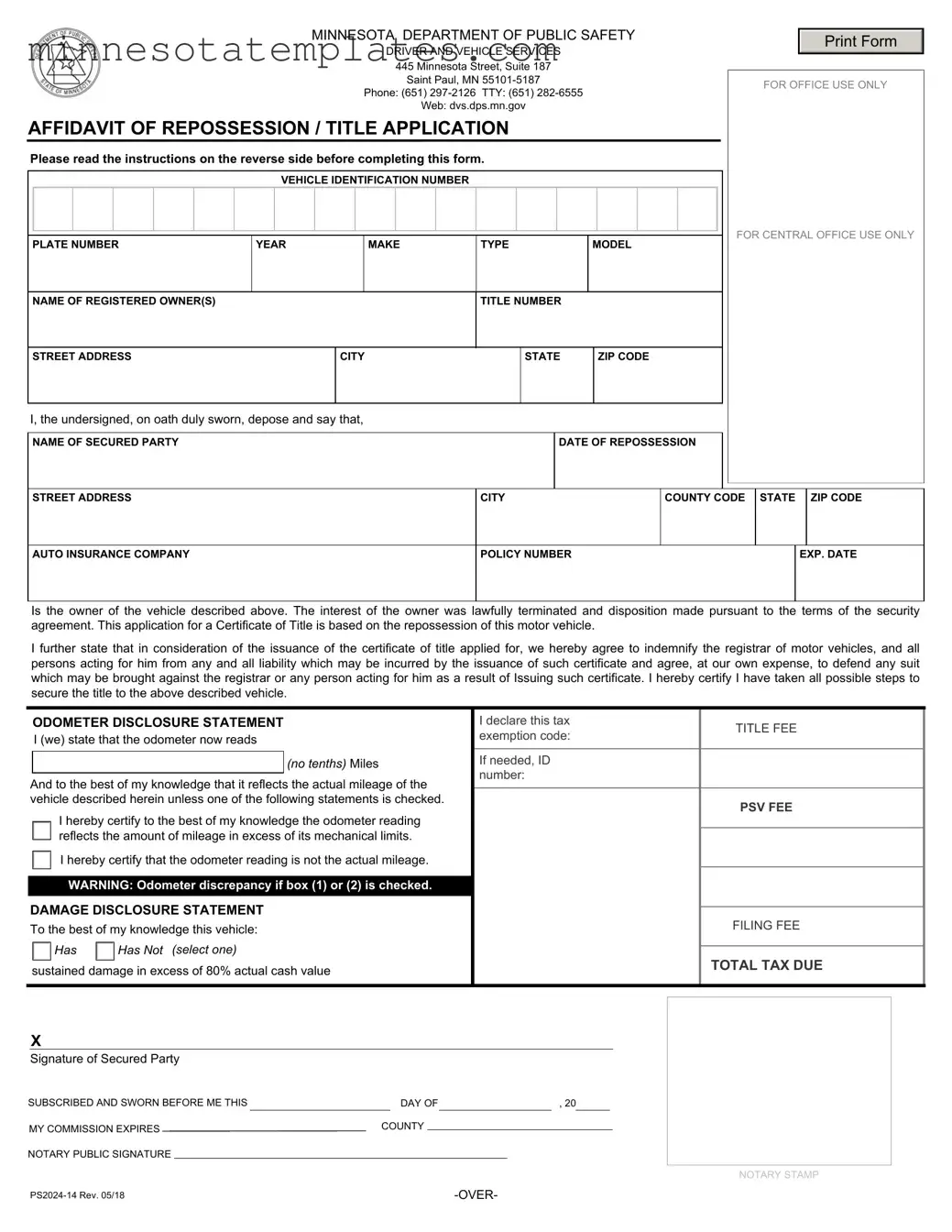

The Affidavit of Repossession form in Minnesota is an essential document for individuals or entities who have repossessed a vehicle due to the owner's failure to meet the terms of a security agreement. This form serves multiple purposes, including acting as an application for a new title for the vehicle. It requires detailed information about the vehicle, such as its identification number, make, model, and the name of the registered owner. Additionally, the form must be completed by the secured party, who certifies that they have taken all necessary steps to secure the title. Notably, it includes sections for odometer disclosure and damage disclosure, ensuring that all relevant information about the vehicle's condition and mileage is accurately reported. The form also outlines the fees associated with titling the vehicle, which may vary depending on whether the repossessing party is a private individual or a business. Proper completion and submission of this form are crucial for the repossessing party to obtain legal ownership and avoid any potential liabilities. Understanding these aspects will help ensure a smooth process when dealing with vehicle repossession in Minnesota.

Key takeaways

Filling out the Affidavit of Repossession Minnesota form requires careful attention to detail. Here are key takeaways to consider:

- Understand the Purpose: This form is used to apply for a title following the repossession of a vehicle.

- Complete All Sections: Ensure that every section of the form is filled out accurately, including vehicle identification, owner information, and secured party details.

- Odometer Disclosure: Provide the current odometer reading and check the appropriate box regarding its accuracy to avoid penalties.

- Damage Disclosure: Indicate whether the vehicle has sustained significant damage. This is crucial for transparency and legal compliance.

- Fees Involved: Be aware that there are fees associated with titling the vehicle, including title, PSV, and filing fees.

- Submission Options: Submit the completed form and any required fees to your local deputy registrar office or by mail to the Minnesota Department of Public Safety.

- Notarization Required: The form must be signed in front of a notary public to validate the information provided.

Misconceptions

Understanding the Affidavit of Repossession in Minnesota can be challenging, and several misconceptions often arise. Here are seven common misunderstandings, along with clarifications to help you navigate the process.

- It is not necessary to notify the owner before repossession. Many believe that once a secured party has the right to repossess a vehicle, they can do so without notifying the owner. However, it is essential to follow the terms outlined in the security agreement and applicable laws, which may require notification.

- The affidavit guarantees ownership of the vehicle. Some people think that submitting the affidavit automatically grants them ownership. In reality, it serves as a formal declaration of repossession, but ownership may still be disputed or challenged.

- Only banks or financial institutions can file an affidavit. There is a misconception that only banks or large financial institutions can file this document. In fact, any secured party, including private individuals, can complete the affidavit as long as they meet the necessary requirements.

- The affidavit is the only document needed for repossession. Many assume that the affidavit alone suffices for repossession. However, other documents, such as the original title or a dealer purchase receipt, may also be required depending on the circumstances.

- Once filed, the affidavit cannot be contested. Some believe that once the affidavit is filed, it is final and cannot be challenged. This is not true. The owner or other interested parties can contest the repossession through legal channels.

- There are no fees associated with filing the affidavit. It is a common myth that filing the affidavit is free of charge. In reality, there are fees for title applications and other related services that must be paid at the time of filing.

- The affidavit eliminates the need for insurance. Some people think that once they have repossessed a vehicle, they no longer need to maintain insurance. However, it is crucial to keep the vehicle insured to protect against potential liabilities until the title is officially transferred.

By addressing these misconceptions, individuals can better understand the process surrounding the Affidavit of Repossession in Minnesota and ensure they comply with all legal requirements.

Additional PDF Templates

Minnesota Lg220 - Information provided in the application is used to assess qualifications for lawful gambling permits.

For those navigating the sales tax refund process, the ST-12B Georgia form is essential, and resources like Forms Georgia provide valuable assistance in understanding the necessary steps and documentation required to successfully submit a claim.

Mn Ticket Lookup - The form includes sections for costs related to witnesses or experts.