Valid Articles of Incorporation Form for the State of Minnesota

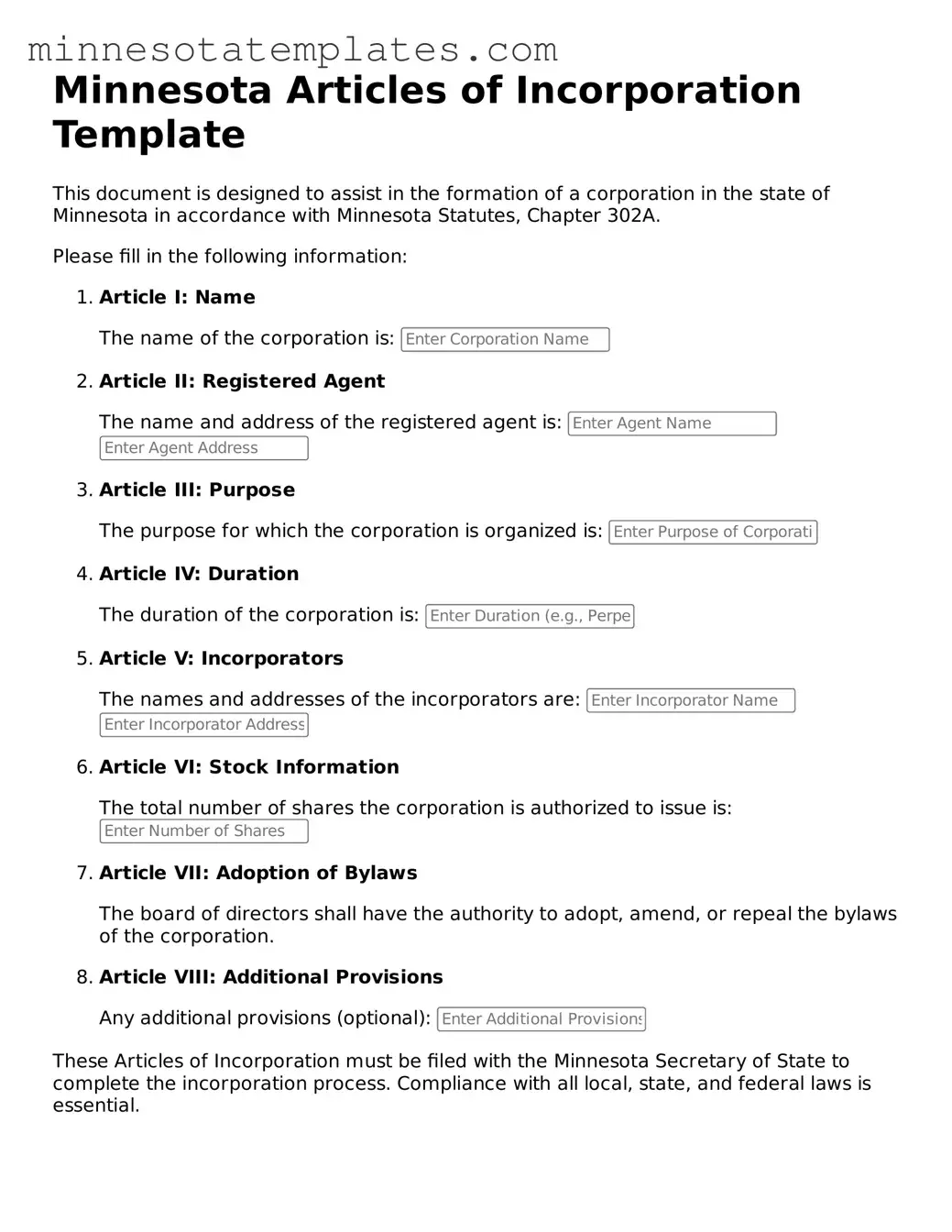

The Minnesota Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form outlines essential information about the business, including its name, registered office address, and the purpose of the corporation. Additionally, it requires details about the incorporators and the number of shares the corporation is authorized to issue. Properly completing this form not only ensures compliance with state laws but also sets the foundation for the corporation's structure and governance. Filing the Articles of Incorporation with the Minnesota Secretary of State is a key step in the incorporation process, allowing entrepreneurs to protect their personal assets and gain credibility in the business world. Understanding the requirements and implications of this form is vital for anyone embarking on the journey of starting a corporation in Minnesota.

Key takeaways

Filing the Minnesota Articles of Incorporation is a significant step for anyone looking to establish a corporation in the state. Here are some key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They officially create your business entity and outline its basic structure.

- Gather Necessary Information: Before filling out the form, collect essential details such as your corporation's name, registered agent, and the number of shares you plan to issue.

- Choose the Right Name: Ensure your corporation's name is unique and complies with Minnesota's naming rules. It must include "Corporation," "Incorporated," or an abbreviation like "Inc." or "Corp."

- File with the Secretary of State: Submit your completed Articles of Incorporation to the Minnesota Secretary of State's office. This can typically be done online, by mail, or in person.

- Know the Fees: Be prepared to pay a filing fee when you submit your Articles. This fee can vary, so check the latest information to avoid surprises.

By keeping these points in mind, you can navigate the incorporation process with greater confidence and clarity.

Misconceptions

Understanding the Minnesota Articles of Incorporation form is crucial for anyone looking to establish a business in the state. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- Filing the Articles of Incorporation is optional. Many believe that submitting this form is not necessary for starting a business. In reality, filing the Articles of Incorporation is essential for legally establishing a corporation in Minnesota.

- All types of businesses must file the same Articles of Incorporation. Some assume that the form is uniform for all business types. However, the requirements can vary based on the specific type of corporation being formed, such as a nonprofit versus a for-profit entity.

- Once filed, the Articles of Incorporation cannot be changed. There is a misconception that the form is final and unchangeable. In fact, amendments can be made to the Articles of Incorporation after filing, allowing businesses to adapt as they grow.

- The Articles of Incorporation determine the operational rules of the corporation. Some individuals think that this document outlines how the corporation will operate. However, while it establishes the corporation's existence, the operational rules are typically detailed in the bylaws, which are separate from the Articles of Incorporation.

By clarifying these misconceptions, individuals can better navigate the process of incorporating a business in Minnesota.

Other Common Minnesota Templates

Medical Power of Attorney Mn - Protect your health care choices by creating a Medical Power of Attorney today.

The Maryland form plays an essential role in facilitating timely communication regarding project assessments. By utilizing the Maryland form, project initiators can effectively relay necessary information to the Maryland Historical Trust and the Maryland State Historic Preservation Office, ensuring that all relevant details about their undertakings are accurately represented and reviewed for compliance with preservation standards.

Form Ps2000 - This legal document designates someone who can sign documents related to your vehicle.

Hennepin Housing Court - Alerts tenants to the seriousness of their rental situation.