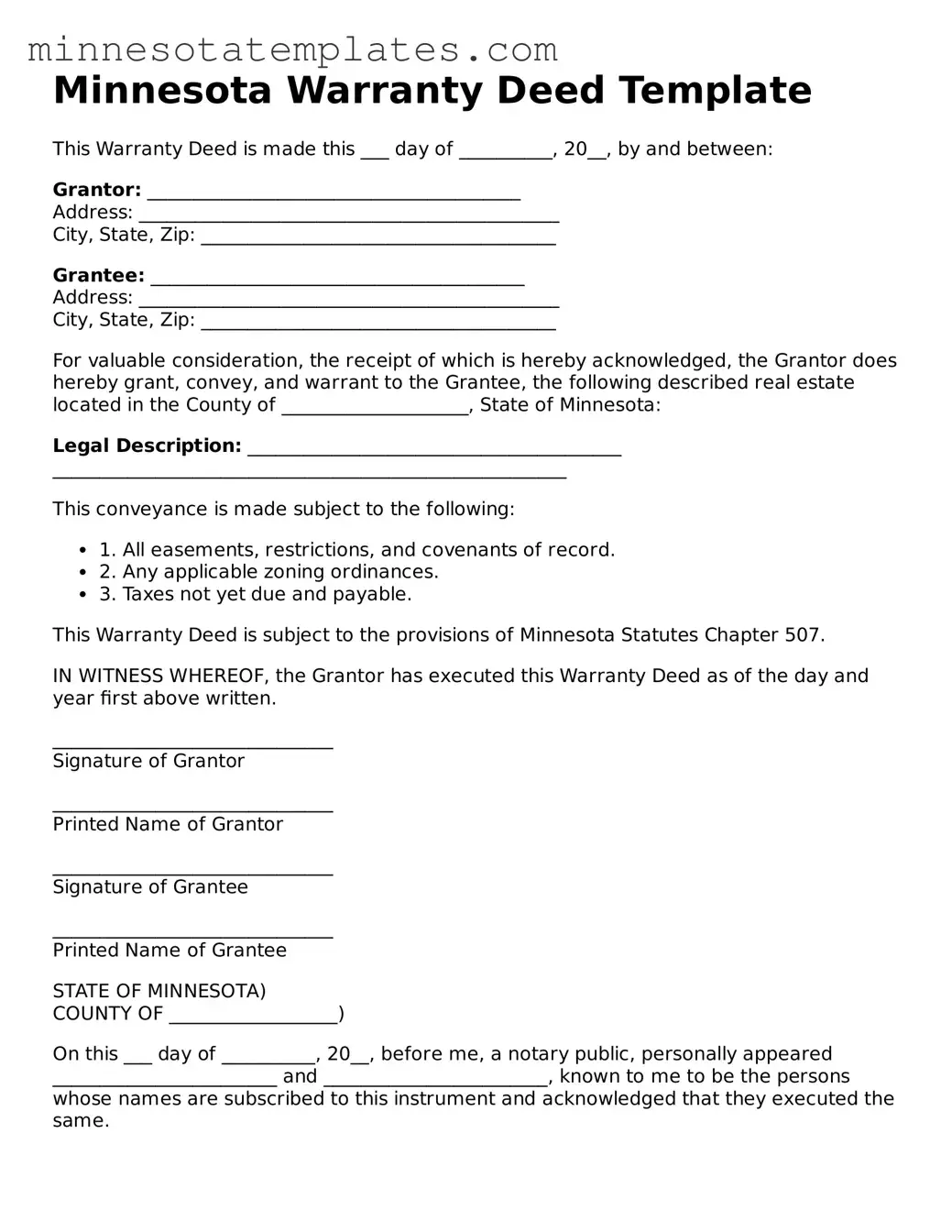

Valid Deed Form for the State of Minnesota

The Minnesota Deed form is an important legal document used in real estate transactions within the state. This form serves to transfer ownership of property from one party to another, ensuring that the rights and responsibilities associated with the property are clearly defined. It includes essential details such as the names of the grantor and grantee, a description of the property being transferred, and any relevant terms of the transfer. Additionally, the form may specify whether the deed is a warranty deed, quitclaim deed, or another type, each carrying different implications for the parties involved. Proper execution of this form is crucial, as it often requires notarization and may need to be filed with the county recorder to be legally effective. Understanding the components of the Minnesota Deed form can help individuals navigate property transactions more smoothly and avoid potential disputes down the line.

Key takeaways

When dealing with the Minnesota Deed form, there are several important points to keep in mind. Understanding these can help ensure a smooth process when transferring property. Here are key takeaways:

- Ensure you have the correct type of deed. Minnesota offers various types, including warranty deeds and quitclaim deeds, each serving different purposes.

- Clearly identify the parties involved. The names of the grantor (the person transferring the property) and the grantee (the person receiving the property) must be accurate and complete.

- Include a legal description of the property. This description should be precise and can often be found in the property’s current deed or tax records.

- Signatures are crucial. The deed must be signed by the grantor, and if there are multiple grantors, all must sign.

- Consider having the deed notarized. While not always required, notarization adds an extra layer of authenticity and can help avoid disputes later.

- Be aware of the recording process. After completing the deed, it should be filed with the county recorder’s office to make the transfer official.

- Check for any outstanding liens or encumbrances on the property. Addressing these issues beforehand can prevent complications during the transfer.

- Understand the tax implications. Transferring property may have tax consequences, so consulting a tax professional can be beneficial.

- Keep copies of the completed deed. Retaining a copy for your records is important for future reference.

- Consult with a real estate professional if needed. They can provide guidance and ensure that all necessary steps are followed correctly.

By following these key points, you can navigate the Minnesota Deed form process with confidence and clarity.

Misconceptions

Understanding the Minnesota Deed form is essential for property transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- The Minnesota Deed form is only for transferring residential property. This form can be used for various types of property, including commercial and agricultural land.

- You need a lawyer to complete a Minnesota Deed form. While legal assistance can be helpful, individuals can fill out the form themselves if they understand the requirements.

- All Minnesota Deed forms are the same. There are different types of deeds, such as warranty deeds and quitclaim deeds, each serving different purposes.

- A notary is not required for the Minnesota Deed form. In fact, notarization is often necessary to ensure the document is legally binding.

- You can use a Minnesota Deed form for any property transfer. Some transfers, like those involving foreclosure or tax forfeiture, may require different documentation.

- The Minnesota Deed form does not need to be recorded. Recording the deed with the county is crucial for establishing legal ownership.

- Once the Minnesota Deed form is signed, it cannot be changed. Amendments can be made, but they require a new deed and proper documentation.

- The form must be filled out in person. Individuals can complete the form remotely, as long as they meet the legal requirements.

- You cannot transfer property to a trust using a Minnesota Deed form. It is possible to transfer property into a trust; specific language must be included in the deed.

- Filing fees are not associated with the Minnesota Deed form. There are typically fees for recording the deed, which vary by county.

Being aware of these misconceptions can help ensure a smoother property transaction process in Minnesota.

Other Common Minnesota Templates

Purchase Agreement Template Minnesota - It could potentially include a clause for property maintenance before closing.

For individuals seeking to ensure their decisions are honored when they cannot actively participate, it is advisable to complete an important legal document, the detailed Power of Attorney form. This form empowers your chosen representative to act in your best interest during critical times.

Transfer Upon Death Deed Minnesota - The deed can only transfer property that the owner solely owns, not jointly held property.