Valid Durable Power of Attorney Form for the State of Minnesota

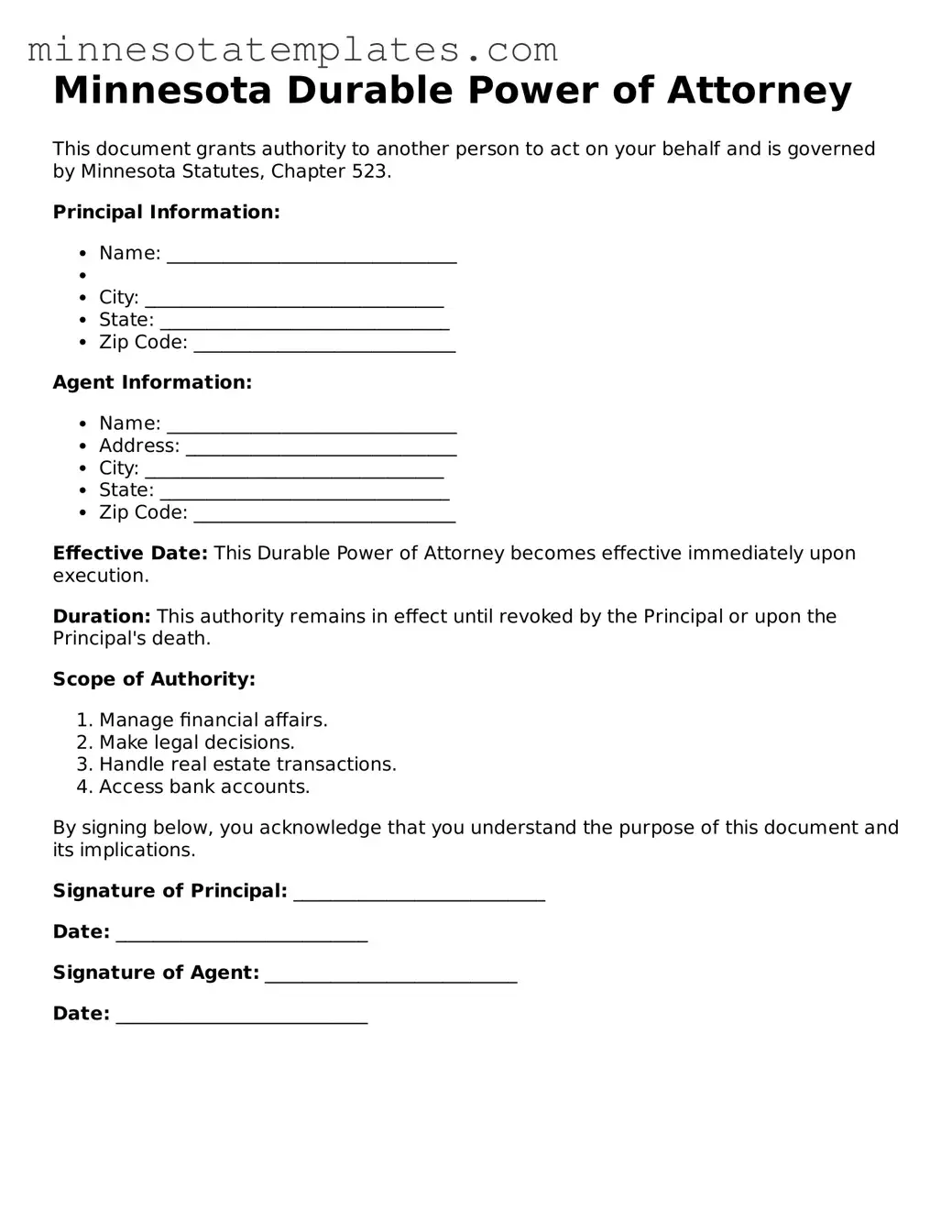

In the realm of estate planning, the Minnesota Durable Power of Attorney form serves as a vital tool for individuals seeking to ensure their financial and healthcare decisions are managed according to their wishes, even if they become incapacitated. This legal document grants authority to a trusted person, known as the agent, to make decisions on behalf of the principal—the individual who creates the document. It covers a wide range of financial matters, including managing bank accounts, paying bills, and handling real estate transactions. Additionally, it can also encompass healthcare decisions, allowing the agent to make medical choices when the principal is unable to communicate their preferences. One of the key features of this form is its durability; it remains effective even if the principal becomes mentally incapacitated, providing peace of mind during uncertain times. Understanding the nuances of this document is essential, as it not only facilitates seamless management of affairs but also helps in avoiding potential conflicts among family members. By establishing a Durable Power of Attorney, individuals can maintain control over their lives, ensuring that their values and preferences are respected, regardless of the circumstances they may face in the future.

Key takeaways

When filling out and using the Minnesota Durable Power of Attorney form, several important points should be considered. These takeaways can help ensure that the document serves its intended purpose effectively.

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so yourself.

- Choose Your Agent Wisely: Select someone you trust completely. This person will have significant authority over your financial matters.

- Specify Powers Clearly: Clearly outline the powers you are granting to your agent. This can include managing bank accounts, real estate, and other financial transactions.

- Consider Future Needs: Think about your long-term needs when creating the document. The powers granted should reflect your expectations for the future.

- Sign and Date the Document: The form must be signed and dated by you in the presence of a notary public to be legally valid.

- Review Regularly: Periodically review the Durable Power of Attorney to ensure it still meets your needs and reflects any changes in your circumstances.

Misconceptions

Understanding the Minnesota Durable Power of Attorney (DPOA) form can be challenging, and several misconceptions often arise. Clearing up these misunderstandings is crucial for anyone considering this important legal document. Here are four common misconceptions:

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: The agent must be a lawyer.

- Misconception 3: A Durable Power of Attorney is only valid while the principal is alive.

- Misconception 4: You can’t change or revoke a Durable Power of Attorney once it’s signed.

While many people associate a DPOA with financial decisions, it can also cover health care decisions. A DPOA can empower someone to make medical choices on your behalf if you become unable to do so.

This is not true. Your agent can be anyone you trust, such as a family member or friend. The key is that they should be someone responsible and capable of handling your affairs.

Actually, a DPOA remains effective even if the principal becomes incapacitated. This is what distinguishes it from a regular power of attorney, which would cease to be valid under such circumstances.

This is a common myth. As long as you are mentally competent, you can revoke or change your DPOA at any time. It’s essential to communicate these changes to your agent and any institutions involved.

Other Common Minnesota Templates

Special Power of Attorney Form - This form is often used in estate planning and financial management.

The California Articles of Incorporation form is a legal document that officially establishes a corporation in the state. It outlines essential information about the business, including its name, purpose, and management structure. If you're ready to start your corporate journey, you can find the necessary documentation by accessing the Articles of Incorporation form and filling it out accordingly.

Quick Claim Deeds Mn - This document is often preferred for its simplicity in property exchanges.