Valid General Power of Attorney Form for the State of Minnesota

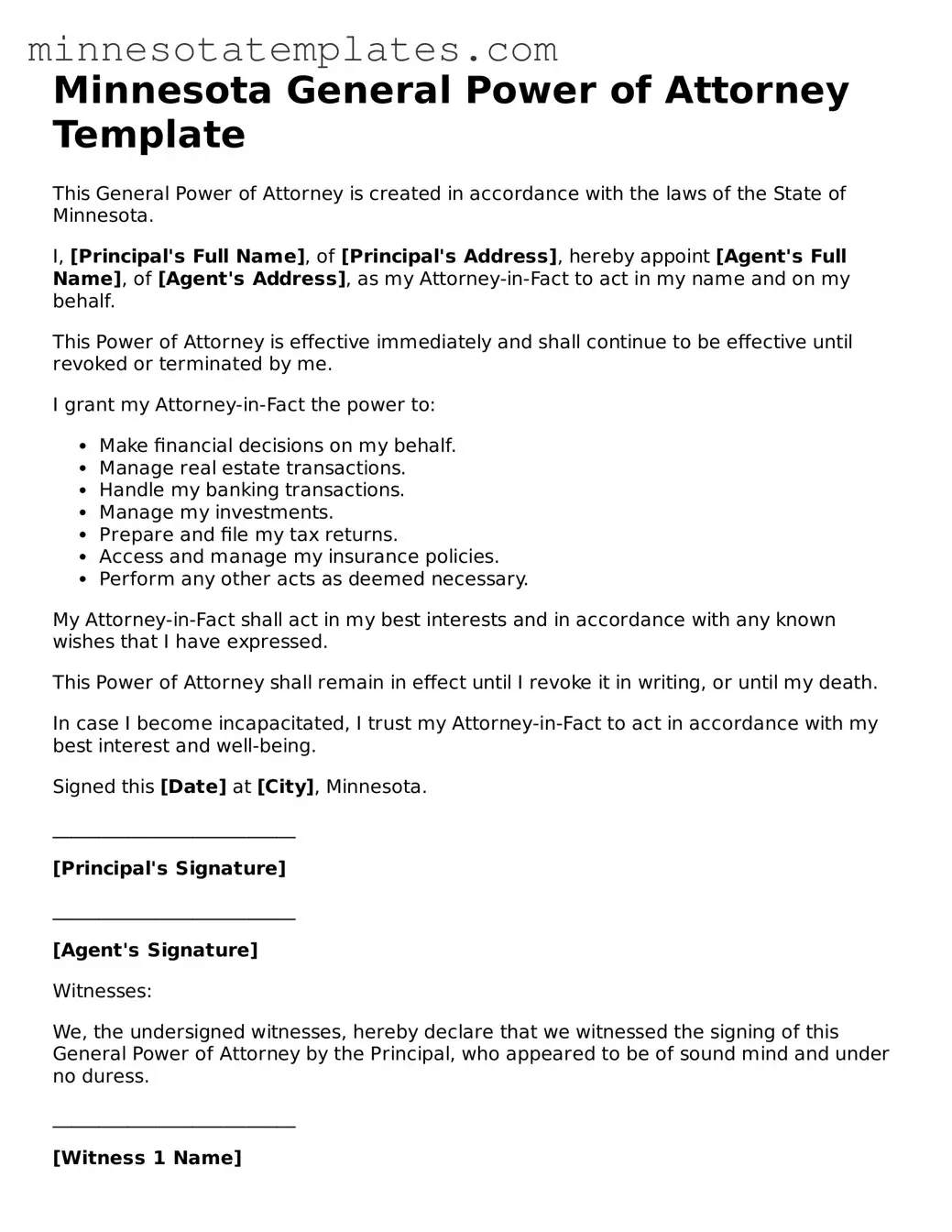

The Minnesota General Power of Attorney form serves as a crucial legal document that empowers individuals to designate someone they trust to manage their financial and legal affairs on their behalf. This form allows the appointed agent, also known as the attorney-in-fact, to make decisions regarding property transactions, banking, and other financial matters, ensuring that the principal's interests are well-represented even when they are unable to act on their own. It is essential to note that the authority granted can be broad or limited, depending on the principal's preferences. Moreover, the Minnesota General Power of Attorney can be effective immediately or can be set to activate only under specific circumstances, such as the principal's incapacity. Understanding the implications of this form is vital, as it not only outlines the powers granted but also includes provisions for revocation and the responsibilities of the agent. By carefully considering the details and potential consequences, individuals can make informed decisions about their future and ensure their affairs are managed according to their wishes.

Key takeaways

Filling out and using the Minnesota General Power of Attorney form requires careful consideration. Here are ten key takeaways to keep in mind:

- The form allows you to designate someone to act on your behalf in financial and legal matters.

- Choose your agent wisely; they will have significant authority over your affairs.

- Sign the document in front of a notary public to ensure its validity.

- Be specific about the powers you are granting to your agent to avoid confusion.

- Review the form regularly, especially if your circumstances change.

- You can revoke the power of attorney at any time as long as you are competent.

- Consider including a durable clause, which allows the power of attorney to remain effective if you become incapacitated.

- Make copies of the signed document and provide them to your agent and relevant financial institutions.

- Understand that your agent must act in your best interest and keep accurate records.

- Consult with a legal professional if you have questions about your specific situation or needs.

Misconceptions

Understanding the Minnesota General Power of Attorney (GPOA) form is crucial for anyone considering its use. However, several misconceptions can lead to confusion. Here are eight common misconceptions, along with clarifications to help set the record straight.

- The GPOA is only for financial matters. Many people think a General Power of Attorney only handles financial decisions. In reality, it can cover a broad range of decisions, including health care and property management.

- It becomes effective only when the principal is incapacitated. Some believe the GPOA only takes effect when the principal can no longer make decisions. However, it can be effective immediately upon signing, depending on how it is drafted.

- Once signed, it cannot be revoked. There is a misconception that a GPOA is permanent. In fact, the principal can revoke it at any time, as long as they are mentally competent.

- Anyone can be appointed as an agent. While it’s true that you can choose your agent, they must be a competent adult. This means minors or individuals who are not mentally capable cannot serve.

- The GPOA must be notarized to be valid. While notarization is recommended and often required by financial institutions, it is not strictly necessary for the GPOA to be legally valid in Minnesota.

- All powers are automatically granted to the agent. Some believe that signing a GPOA gives the agent unlimited authority. In reality, the principal can specify which powers are granted and which are not.

- Using a GPOA means losing control over your decisions. Many fear that granting a GPOA means they will no longer have a say in their affairs. This is not true; the principal can still make decisions alongside the agent.

- GPOAs are only for older adults. While they are often associated with older individuals, anyone can benefit from a GPOA, especially those who travel frequently or have complex financial situations.

By addressing these misconceptions, individuals can make more informed decisions about whether a Minnesota General Power of Attorney is right for them. Understanding the nuances can empower you to take control of your legal and financial affairs.

Other Common Minnesota Templates

Rental Application Form Minnesota - Bank references provide further proof of your financial standing.

The North Carolina Lease Agreement form is a crucial document that not only defines the relationship between landlords and tenants but also serves to protect both parties' rights. It is advisable for anyone entering into a rental agreement to familiarize themselves with the details provided in the Lease Agreement form, which outlines payment structures, property usage, and maintenance expectations, ensuring a smooth rental experience for all involved.

Purchase Agreement Template Minnesota - Buyers can ensure there are provisions for future use of the land.

How to Homeschool in Minnesota - It is advisable to seek guidance if questions arise while filling out the form.