Blank Jgm301 Template

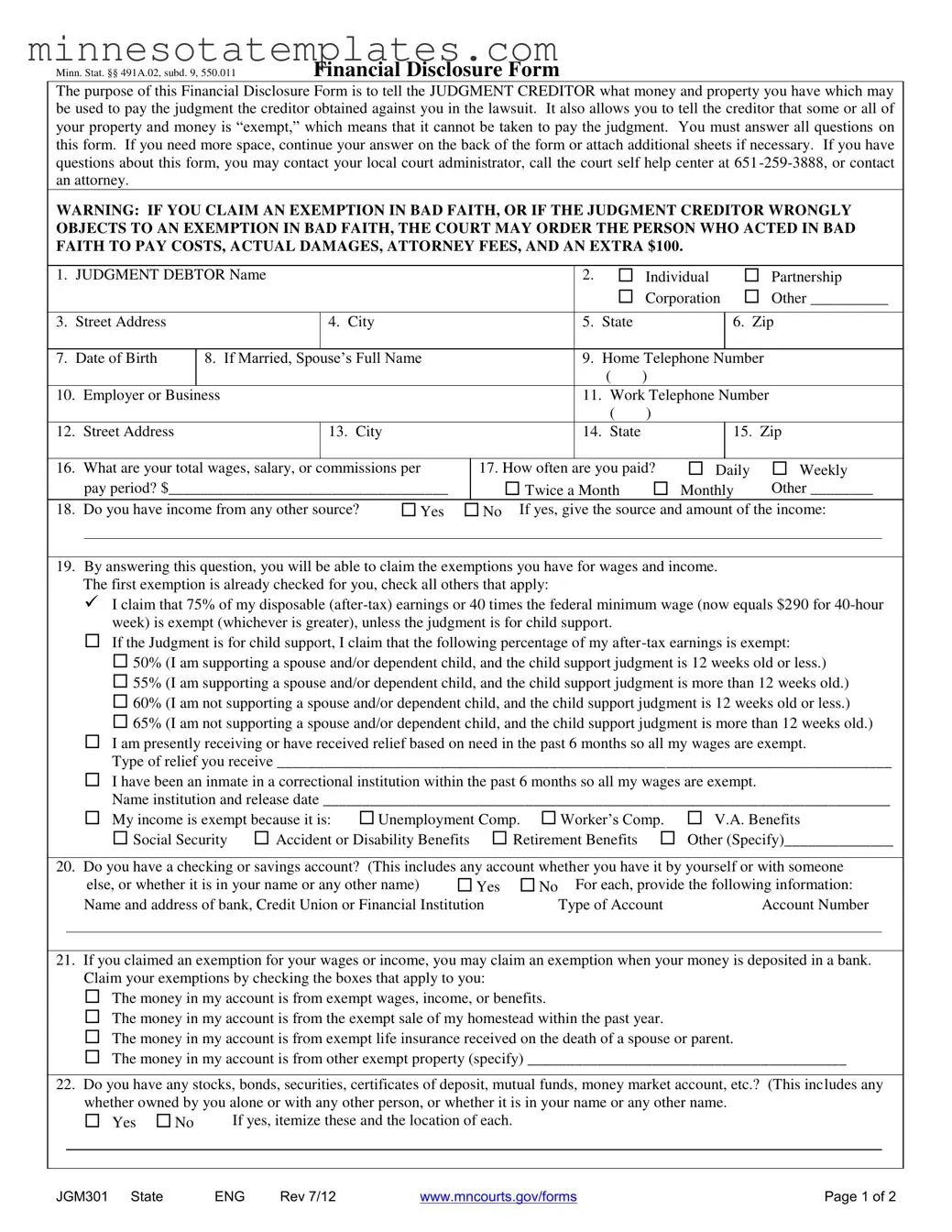

The JGM301 form serves a critical function in the legal landscape of financial disclosure, particularly for individuals facing judgments from creditors. This form is designed to provide a comprehensive overview of a judgment debtor's financial situation, detailing both income and assets that may be subject to claims by creditors. It requires the debtor to disclose personal information, such as their name, address, and employment details, as well as specifics about their income sources, including wages and any additional earnings. A significant aspect of the JGM301 is the opportunity it provides for debtors to assert exemptions. These exemptions protect certain income and property from being seized to satisfy a judgment, thereby allowing individuals to retain essential resources for their livelihood. The form includes a variety of questions that guide debtors in identifying exempt income, such as specific percentages of disposable earnings or particular types of benefits. Additionally, it prompts debtors to report on their bank accounts, real estate holdings, vehicles, and other personal property, ensuring a thorough financial disclosure. Importantly, the JGM301 also carries a warning about the potential consequences of claiming exemptions in bad faith, underscoring the necessity for accuracy and honesty in the completion of the form. By requiring detailed responses and providing space for additional information, the JGM301 form facilitates a transparent dialogue between debtors and creditors, helping to navigate the complexities of financial obligations and rights in the context of legal judgments.

Key takeaways

Filling out the Jgm301 form is an important step in managing your financial obligations. Here are key takeaways to keep in mind:

- The Jgm301 form is used to disclose your financial information to the judgment creditor.

- It is essential to answer all questions on the form completely.

- If you need more space, you can continue your answers on the back of the form or attach additional sheets.

- Claiming exemptions is crucial. Some of your property may be protected from being used to pay the judgment.

- Be aware that if you claim an exemption in bad faith, you could face penalties.

- Include your total wages, salary, or commissions and how often you are paid.

- List any other sources of income you may have, as this information is necessary for your financial assessment.

- Disclose all bank accounts, including those held jointly with others.

- Provide accurate details about any property you own, including your home and vehicles.

- Submit the completed form to the judgment creditor within 10 days to avoid potential legal consequences.

Remember, if you have questions while filling out the form, you can reach out to your local court administrator or a legal professional for guidance.

Misconceptions

There are several misconceptions surrounding the JGM301 form, which can lead to confusion for individuals required to complete it. Here are five common misconceptions:

- The JGM301 form is optional. Many believe that completing this form is not mandatory. In reality, failing to complete, sign, and return the form within 10 days can lead to serious consequences, including a citation for civil contempt of court.

- All property is subject to seizure to pay the judgment. Some individuals think that all their assets can be taken to satisfy a judgment. However, the form allows individuals to claim exemptions for certain types of property, meaning that some assets may be protected from seizure.

- You do not need to disclose all sources of income. There is a misconception that only primary income needs to be reported. The form requires individuals to disclose all sources of income, including wages, benefits, and any other earnings, to accurately assess what can be claimed as exempt.

- Claiming exemptions is straightforward and requires no documentation. Many people assume that simply checking a box is sufficient to claim an exemption. In fact, individuals may need to provide documentation or further explanation to support their claims for exemptions.

- Exemptions are the same for everyone. Some believe that the exemptions available apply uniformly to all individuals. However, exemptions can vary based on individual circumstances, such as marital status or specific types of income, making it essential to understand which exemptions apply to one's situation.

Additional PDF Templates

Post Office Forms - The form highlights the necessity of keeping purity records for at least two years post-testing.

The Maryland Quarterly Contribution Report form is essential for employers aiming to meet their obligations. By using the Maryland Quarterly Contribution Report form, employers can effectively report their Unemployment Insurance contributions and wages each quarter, ensuring compliance with the State of Maryland's regulations.

Mn Repo Laws - Relevant county and state information is required on the affidavit.