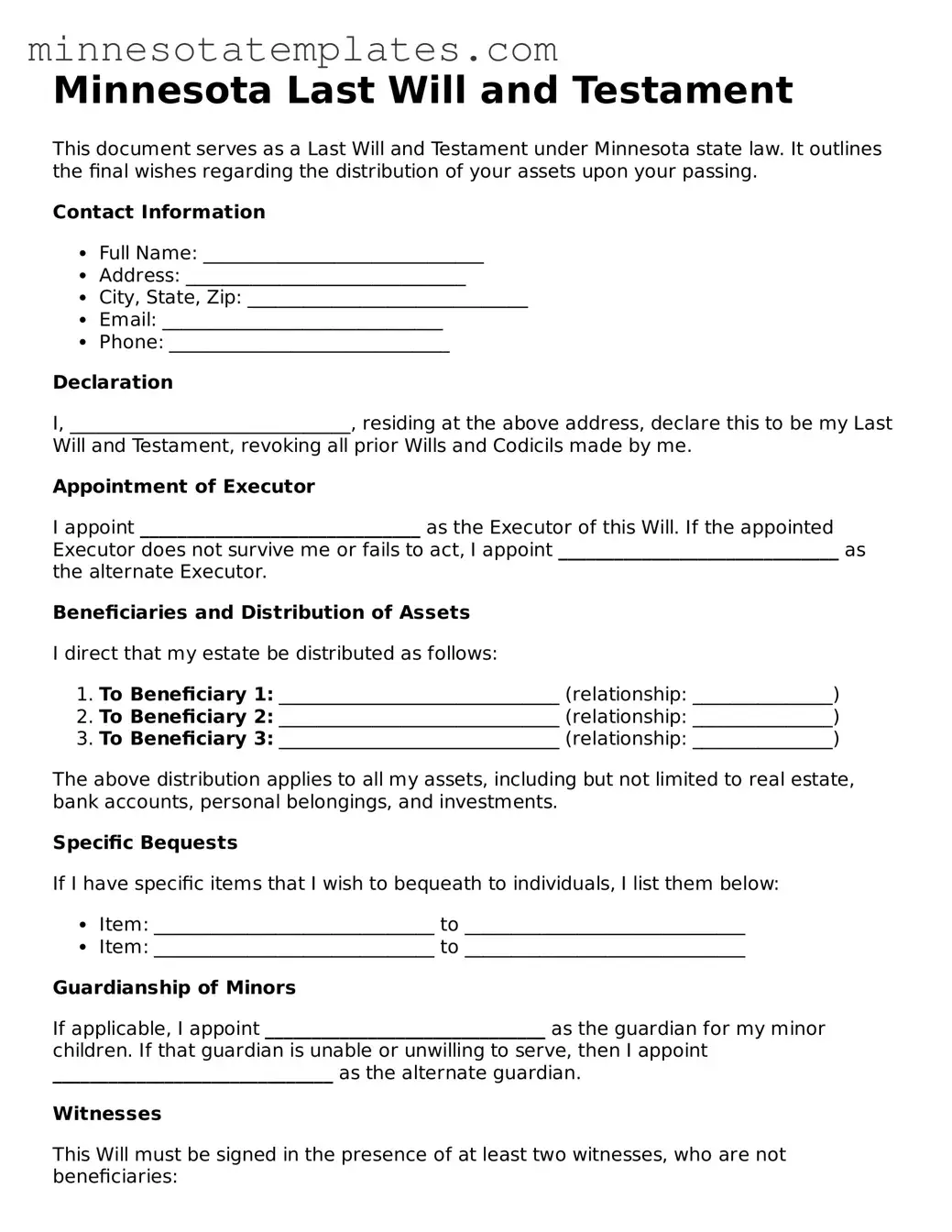

Valid Last Will and Testament Form for the State of Minnesota

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after you pass away. In Minnesota, this legal document allows you to specify how your assets will be distributed, who will care for your minor children, and appoint an executor to manage your estate. By outlining your preferences, you provide clarity and reduce potential conflicts among family members during a difficult time. The Minnesota Last Will and Testament form includes sections for naming beneficiaries, detailing specific bequests, and establishing guardianship for dependents. Additionally, it requires your signature and the signatures of at least two witnesses to validate your intentions. Understanding this form and its components can help you make informed decisions that reflect your values and protect your loved ones.

Key takeaways

Ensure that you clearly identify yourself at the beginning of the document. This includes your full name and address. Doing so establishes your identity and confirms that you are the testator, the person making the will.

Designate an executor to manage your estate after your passing. This individual will be responsible for ensuring that your wishes are carried out as specified in your will.

Be explicit about how you want your assets distributed. Clearly list your beneficiaries and detail what each person will receive. This clarity helps prevent disputes among family members.

Include a clause regarding the guardianship of any minor children. If you have children under 18, it is essential to name a guardian to care for them in the event of your death.

Sign the document in the presence of two witnesses. Minnesota law requires that your will be signed by you and witnessed by two individuals who are not beneficiaries. This step is crucial for the will's validity.

Store the will in a safe place and inform your executor where it can be found. Accessibility is key to ensuring that your wishes are honored after your passing.

Misconceptions

Understanding the Minnesota Last Will and Testament form is essential for anyone looking to ensure their wishes are honored after their passing. However, several misconceptions can lead to confusion. Here are ten common myths surrounding this important legal document:

- Only wealthy individuals need a will. Many people believe that wills are only for the rich. In reality, anyone with assets, regardless of their value, should have a will to dictate how those assets are distributed.

- Wills are only for older adults. Some think that wills are only necessary for the elderly. However, life is unpredictable, and having a will in place at any age can provide peace of mind.

- Verbal wills are legally binding. Many assume that if they verbally express their wishes to family or friends, it will hold up in court. Unfortunately, verbal wills are not legally recognized in Minnesota.

- Once a will is created, it cannot be changed. This is a common misconception. Wills can be amended or revoked at any time, as long as the person creating the will is of sound mind.

- All assets automatically go to the spouse. Some people believe that their spouse will inherit everything. In Minnesota, this is not always the case, especially if there are children from a previous relationship.

- Handwritten wills are not valid. While it’s true that formal wills are typically typed and witnessed, Minnesota does allow handwritten wills, known as holographic wills, as long as they meet certain criteria.

- Wills avoid probate. Many think that having a will means their estate will bypass probate. In reality, all wills must go through probate, although having a will can simplify the process.

- Only lawyers can draft a will. While it is advisable to consult a lawyer for legal advice, individuals can create their own wills using templates, as long as they comply with state laws.

- Once filed, a will is public information. Some believe that all wills are immediately accessible to the public. While probate records are public, the will itself is not available until it is submitted to probate.

- Wills cover all aspects of estate planning. Many think that a will is the only document needed for estate planning. In fact, other documents, such as trusts and powers of attorney, may also be necessary for comprehensive planning.

Being informed about these misconceptions can help individuals make better decisions regarding their estate planning. A well-prepared will can provide clarity and ease during a difficult time for loved ones.

Other Common Minnesota Templates

Minnesota Notary Examples - Notary Acknowledgments can be tailored to specific state requirements.

When engaging in the sale of agricultural machinery, it is crucial to utilize the correct documentation to ensure a smooth transaction. The Georgia Tractor Bill of Sale form not only serves as a legal record but also provides clarity on the details of the sale, including the purchase price and essential vehicle identification. To facilitate this process effectively, you can access the necessary form through Forms Georgia, which helps ensure that both buyers and sellers are well-informed and protected in their agreement.

Form Ps2000 - The Motor Vehicle Power of Attorney provides flexibility in managing your vehicle's legal aspects.

Minnesota Vehicle Bill of Sale - This form assists law enforcement in verifying ownership in case of theft.