Blank Minnesota Crp Template

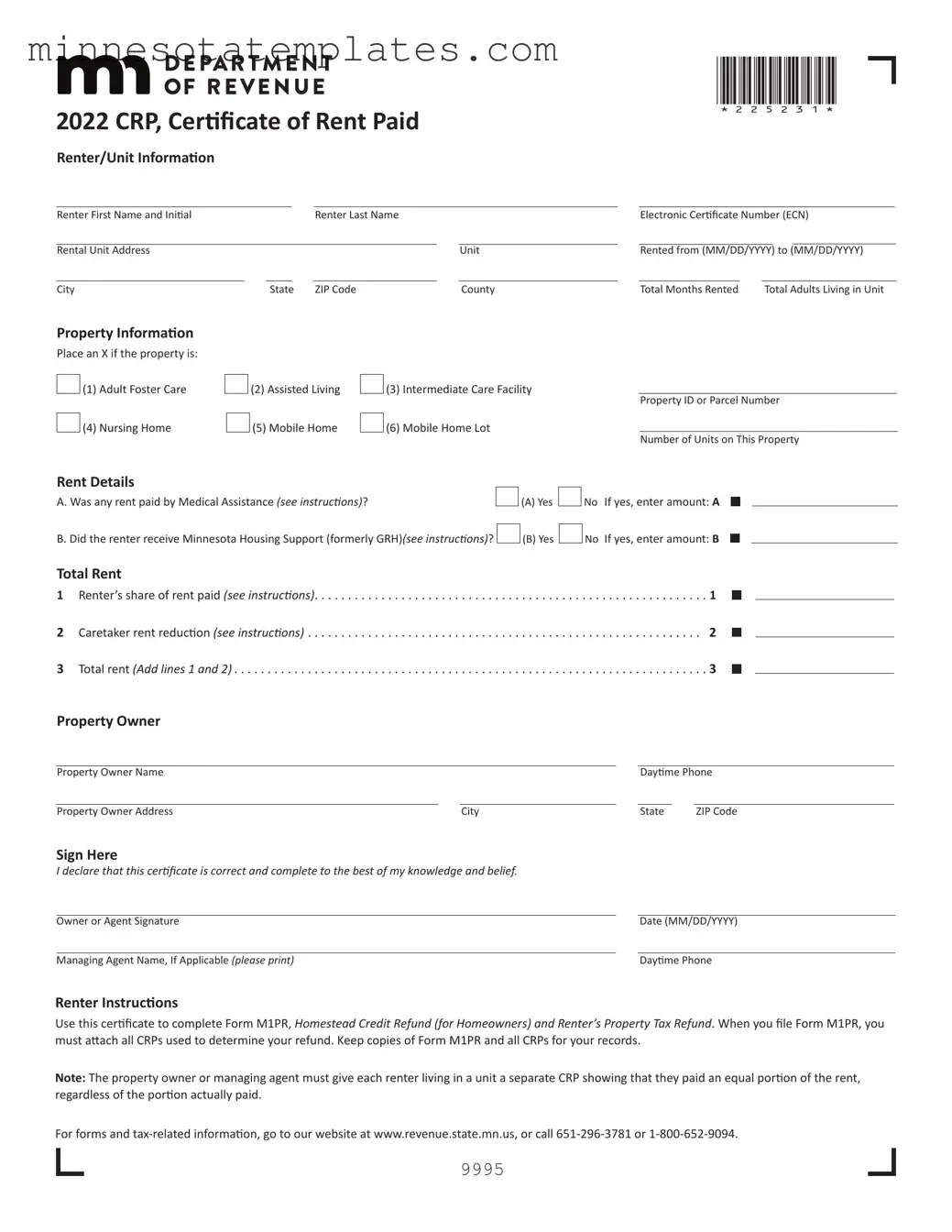

The Minnesota Certificate of Rent Paid (CRP) form serves as a crucial document for renters in the state, facilitating access to financial relief through property tax refunds. Designed to collect essential information about both the renter and the property, the form includes sections for renter details, property specifics, and rent payment information. Renters must provide their names, rental unit addresses, and the duration of their tenancy. Additionally, the form requires property owners to indicate whether the rental property falls under specific categories such as adult foster care or assisted living facilities. Rent details are a significant aspect of the CRP, where renters must disclose any rent covered by Medical Assistance or Minnesota Housing Support, along with their share of the rent. This information is vital for accurately completing Form M1PR, which is used to claim the Homestead Credit Refund and Renter’s Property Tax Refund. It is imperative that property owners issue a separate CRP for each renter in a unit, ensuring that all renters are recognized for their contributions to the rent, regardless of the actual amounts paid. Understanding the requirements and process of the CRP is essential for renters seeking to navigate the complexities of property tax refunds in Minnesota.

Key takeaways

Filling out the Minnesota CRP form is an essential step for renters seeking property tax refunds. Here are key takeaways to ensure a smooth process:

- Accurate Information: Provide correct renter and property details. This includes names, addresses, and rental dates.

- Electronic Certificate Number: Include the Electronic Certificate Number (ECN) for proper identification of the rental unit.

- Property Type: Indicate the type of property by marking the appropriate box, such as Adult Foster Care or Assisted Living.

- Rent Payments: Clearly state if any rent was paid by Medical Assistance or Minnesota Housing Support. This information impacts the total rent calculation.

- Separate CRPs: Each renter must receive an individual CRP, even if they share the rental unit. This ensures accurate reporting of each person's rent contribution.

- Retention of Copies: Keep copies of the CRP and Form M1PR for your records. These documents are necessary for filing and future reference.

Following these guidelines will help in accurately completing the Minnesota CRP form, facilitating the process of obtaining potential tax refunds.

Misconceptions

-

Misconception 1: The Minnesota CRP form is only for homeowners.

This is not true. The Certificate of Rent Paid (CRP) is specifically designed for renters as well. Renters use this form to apply for property tax refunds, just like homeowners do with their property tax statements.

-

Misconception 2: Only the property owner needs to fill out the CRP form.

While the property owner or managing agent must complete certain sections, renters also play a vital role. Renters need to ensure that their information is accurate and that they receive their own copy of the CRP, which reflects their portion of the rent paid.

-

Misconception 3: The CRP form is optional for renters.

In reality, the CRP form is essential for renters who want to claim a property tax refund. Without this certificate, renters may not be able to complete Form M1PR, which is necessary for obtaining any potential refunds.

-

Misconception 4: All renters are eligible for a refund regardless of their situation.

This is misleading. Not all renters qualify for property tax refunds. Eligibility depends on several factors, including income level and the amount of rent paid. It is important for renters to review the specific criteria outlined by the state to determine their eligibility.

Additional PDF Templates

Mn Ticket Lookup - Costs associated with expert testimony can be claimed through this form.

To facilitate the verification of your employment status, it is important to complete the process by accessing the necessary document. You can find the required Employment Verification form online, which is vital for ensuring your information is accurate and helps establish your job stability to interested parties.

Mn New Hire Reporting - The information provided helps foster a reliable labor market system in Minnesota.