Blank Minnesota Ig257 Template

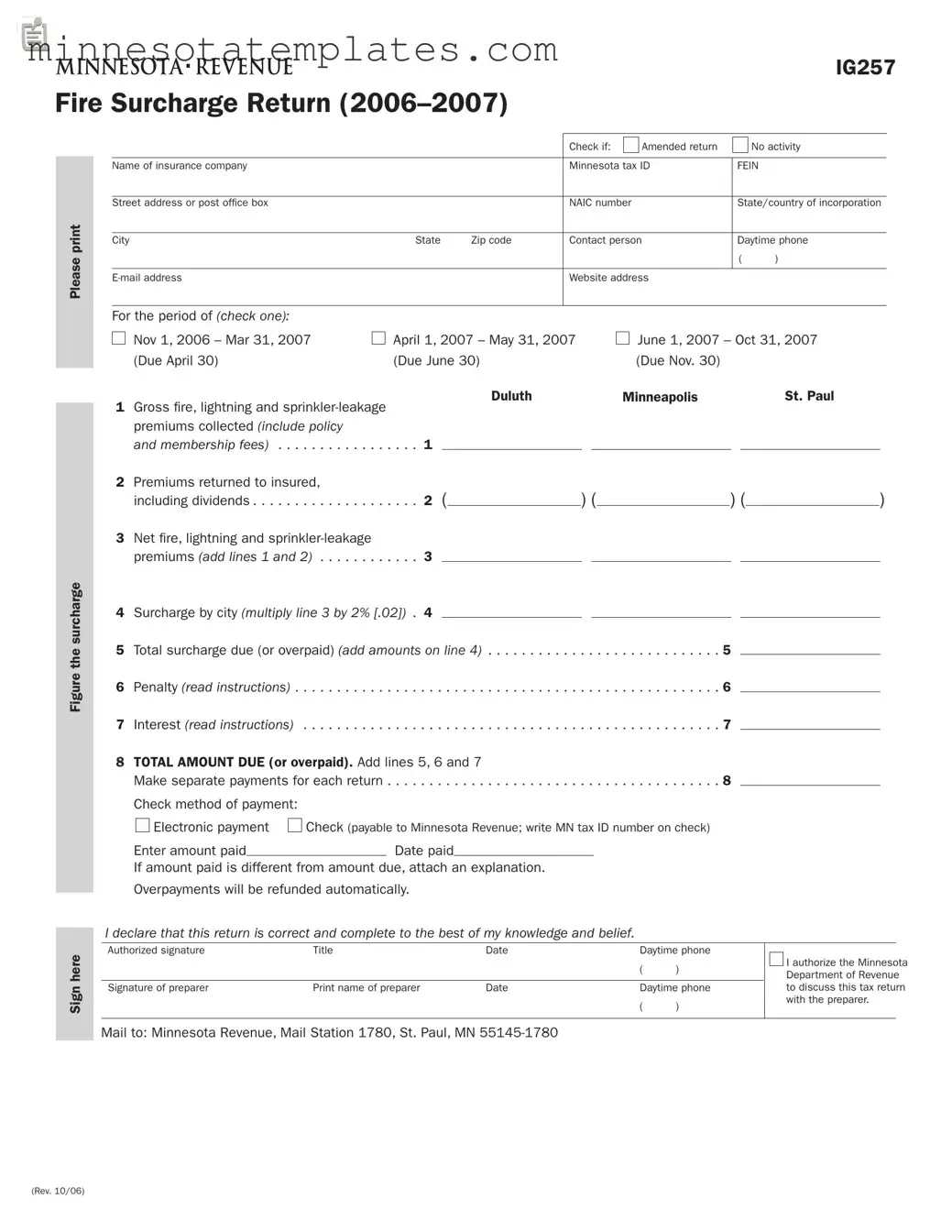

The Minnesota IG257 form is a critical document for insurance companies operating within the cities of Duluth, Minneapolis, and St. Paul. This form, known as the Fire Surcharge Return, is required for reporting fire, lightning, and sprinkler-leakage premiums collected during specific periods. Insurers must complete this form even if no premiums were collected, ensuring compliance with state regulations. The surcharge, set at 2% of the gross premiums, is calculated after deducting any returned premiums. Key components of the form include details such as the insurance company’s name, tax identification numbers, and contact information, as well as sections for calculating the total surcharge due, penalties, and interest if applicable. It is essential to note the due dates for submissions, which vary based on the reporting period, and the requirement for electronic payments for certain tax amounts. Additionally, the form provides options for filing amended returns and indicates the necessity for separate payments for each reporting period. Understanding these aspects is vital for compliance and to avoid penalties that may arise from late submissions or incorrect filings.

Key takeaways

When filling out and using the Minnesota IG257 form, keep these key takeaways in mind:

- Know the Due Dates: The return must be filed by specific dates depending on the reporting period. For example, returns for the period ending March 31 are due by April 30.

- Understand the Surcharge: The surcharge is 2% of gross fire, lightning, and sprinkler-leakage premiums collected. This applies to all insurers, even if no premiums were collected in the specified cities.

- Separate Payments: Make separate payments for each return period. If you owe for multiple periods, do not combine them into one payment.

- Electronic Payment Requirement: If your total taxes and surcharges exceeded $120,000 in the previous year, you must pay electronically. This includes using online services or phone payments.

- Penalties for Late Filing: Be aware that late filing or late payment can result in penalties. These can accumulate quickly, reaching up to 20% of the unpaid tax.

Misconceptions

Misconceptions about the Minnesota IG257 Form

- The IG257 form is only for companies that have collected premiums. Many believe that if no premiums were collected, the form does not need to be filed. However, all insurers licensed to write fire, lightning, and sprinkler leakage insurance in Minnesota must submit the form, even if no business was done in the specified cities.

- The surcharge only applies to fire insurance. Some people think the surcharge is limited to fire insurance alone. In reality, it also includes lightning and sprinkler leakage premiums, which are often overlooked.

- Only large insurance companies need to file the form. It’s a common misconception that only big players in the insurance market are required to file. In truth, any licensed insurer, regardless of size, must complete the IG257 form.

- The surcharge is optional. Some may believe that the surcharge can be ignored or is voluntary. This is incorrect; the surcharge is mandatory and must be calculated and reported accurately.

- The due dates are flexible. Many assume that filing deadlines can be adjusted. However, the due dates for the IG257 form are strict, and late submissions can incur penalties.

- Insurance companies can pay the surcharge on behalf of the insured. There’s a misunderstanding that insurers can cover the surcharge costs. In fact, the insured must pay the surcharge, and the insurance company is responsible for forwarding it to the Department of Revenue.

- All insurance premiums are subject to the surcharge. Some individuals think that every type of insurance premium falls under this surcharge. However, premiums for auto, aircraft, and marine fire insurance are exempt from this requirement.

- Electronic payment is optional. It is often believed that electronic payment is a choice. However, if an insurer’s total taxes and surcharges exceed $120,000, electronic payment becomes a requirement.

- Late penalties are minimal and can be ignored. Some may think that late penalties are insignificant. In reality, they can accumulate quickly, reaching up to 20 percent of the unpaid tax if not addressed promptly.

Additional PDF Templates

Mn Charitable Gambling - It plays a role in the broader context of corporate governance.

When dealing with vehicle transactions, it's important to have the right documentation. This is why utilizing the Alabama Motor Vehicle Bill of Sale form guide can be incredibly beneficial. It helps ensure that both parties involved in the sale are protected and that all necessary information is accurately recorded. Being informed about this form will streamline your buying or selling process significantly.

Mn Repo Laws - It is important to review instructions before completing the form.