Blank Minnesota Ig260 Template

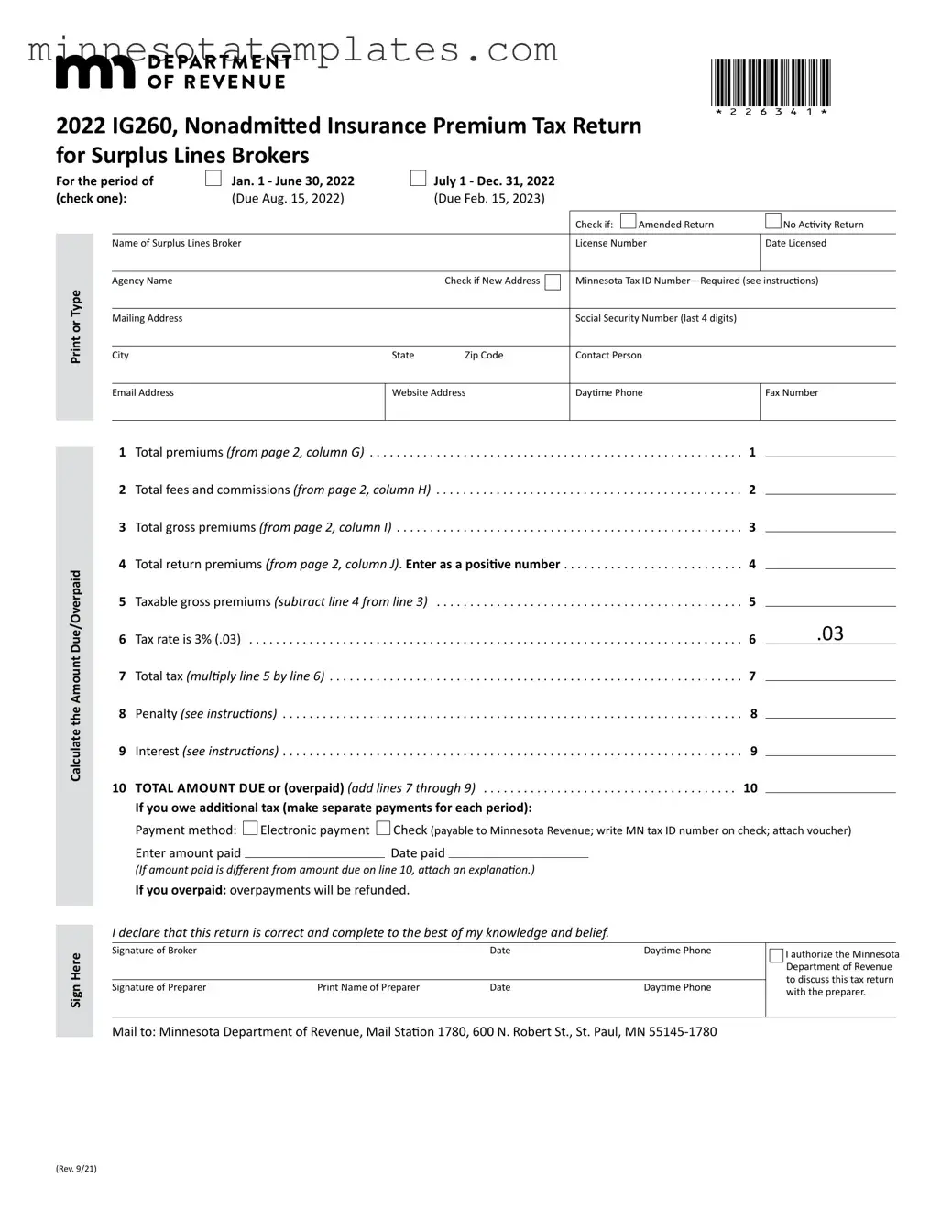

The Minnesota IG260 form is an essential document for surplus lines brokers who deal with nonadmitted insurance. This form must be filed semiannually, covering two distinct periods: January 1 to June 30 and July 1 to December 31. Each period has its own due date, with the first due by August 15 and the second by February 15 of the following year. Even if there is no activity or tax liability to report, brokers are still required to submit this form. The IG260 collects crucial information, including the total premiums, fees, and commissions, as well as taxable gross premiums. A tax rate of 3% applies to the taxable gross premiums, and brokers must calculate the total tax due, including any penalties or interest for late payments. Accurate reporting is vital, as brokers are held accountable for their filings. Additionally, the form requires a Minnesota tax ID number, which is distinct from a Social Security number. This ensures that all brokers are properly registered for tax purposes. Understanding the nuances of the IG260 form is critical for compliance and to avoid potential penalties.

Key takeaways

Filling out the Minnesota IG260 form is essential for surplus lines brokers. Here are key takeaways to ensure compliance and accuracy:

- Understand the Filing Requirement: All surplus lines brokers must file Form IG260, even if there is no activity or tax liability during the reporting period.

- Know the Due Dates: The form is due on August 15 for the period ending June 30 and February 15 for the period ending December 31.

- Required Tax ID: A Minnesota tax ID number is mandatory for all surplus lines brokers. This is distinct from a Social Security number.

- Electronic Payments: If your total insurance taxes exceed $10,000, electronic payment is required for subsequent years.

- Complete Page 2 First: Fill out page 2 before page 1. This includes entering details about premiums and transactions.

- Check for Amended Returns: If you are amending a previously filed return, check the appropriate box at the top of the form.

- Calculate Tax Accurately: The taxable gross premiums are calculated by subtracting total return premiums from total gross premiums.

- Late Payment Penalties: Be aware that late payments incur penalties, starting at 5% of the unpaid tax for the first 30 days.

- Interest on Unpaid Tax: Interest accrues on unpaid tax and penalties from the due date until paid, at a rate of 3% for 2021.

- Update Business Information: Notify the Minnesota Department of Revenue within 30 days of any changes to your business information.

By following these guidelines, surplus lines brokers can effectively manage their tax obligations and ensure compliance with Minnesota regulations.

Misconceptions

The Minnesota IG260 form is a crucial document for surplus lines brokers, yet several misconceptions persist regarding its requirements and implications. Below is a list of common misunderstandings:

- Only active brokers need to file the IG260 form. In fact, all surplus lines brokers must file this form, even if there is no activity or tax liability during the reporting period.

- The IG260 form is optional for brokers. This is incorrect. Filing the IG260 is mandatory under Minnesota law for all brokers engaged in nonadmitted insurance.

- Filing deadlines are flexible. Deadlines for the IG260 form are strict. Returns for the first half of the year are due by August 15, and those for the second half are due by February 15 of the following year.

- A Social Security number can be used instead of a Minnesota tax ID. This is a misconception. Brokers must have a Minnesota tax ID number, which is distinct from a Social Security number.

- Late fees are only applied if the form is filed late. Late payment penalties apply if taxes are not paid by the due date, regardless of whether the form itself is filed on time.

- All premiums are taxable regardless of the insured's location. Only gross premiums related to risks located in Minnesota are taxable. If the insured risk is entirely outside Minnesota, different rules apply.

- Amended returns can be filed without including all original policies. When filing an amended return, all original and corrected policies must be included to ensure accuracy.

- Electronic payments are not mandatory. If a broker's total insurance taxes exceed $10,000 for the last 12-month period, electronic payment is required in subsequent years.

- Interest does not accrue on unpaid taxes until the form is filed. Interest on unpaid taxes begins accruing from the due date, regardless of the filing status of the form.

Understanding these misconceptions can help ensure compliance and avoid penalties associated with the Minnesota IG260 form.

Additional PDF Templates

Self Employment Tax Mn - Specific details on loss years and deductions are integral to the M4Np process.

The ST-12B Georgia form is not only crucial for obtaining a sales tax refund but also emphasizes the importance of using reliable resources, such as Forms Georgia, to guide individuals through the application process. By familiarizing oneself with this form and its requirements, taxpayers can enhance their chances of a smooth and successful refund experience in Georgia.

Dealer License Mn - Dealers should back up all information with appropriate evidence of claims made on the form.

Minnesota Lg220 - Charitable gaming helps support various nonprofit activities within the community.