Blank Minnesota Lg214 Template

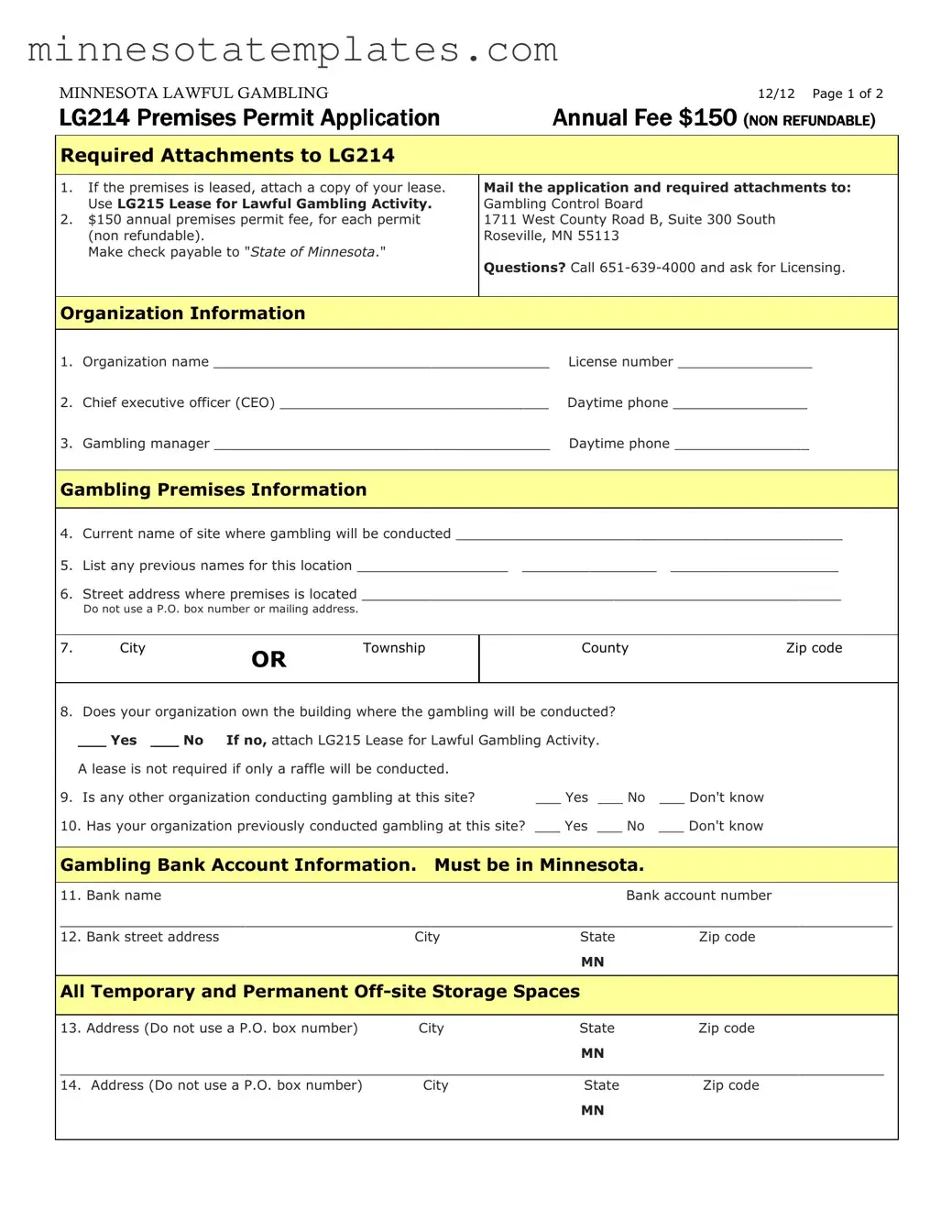

The Minnesota LG214 form is an essential document for organizations operating within the state, particularly those involved in the realm of non-profit activities. This form serves multiple purposes, including the collection of necessary information about the organization’s structure and operations. It typically requires details such as the name of the organization, its mission, and the names of key personnel, including the Chief Executive Officer. Additionally, the form may include sections for financial disclosures, which provide insight into the organization's fiscal health and accountability. Completing the LG214 form accurately is crucial for compliance with state regulations, and it helps ensure that the organization maintains its good standing. Understanding the components and requirements of the LG214 form is vital for any organization looking to navigate the regulatory landscape in Minnesota effectively.

Key takeaways

1. Understand the Purpose: The Minnesota Lg214 form is essential for specific legal and administrative processes. Ensure you know why you're filling it out.

2. Accurate Information is Crucial: Double-check all entries. Mistakes can delay processing and may lead to further complications.

3. Signature Requirement: The form must be signed by the Chief Executive Officer or an authorized designee. No one else can sign.

4. Submission Guidelines: Be aware of where and how to submit the form. Follow the instructions carefully to avoid any issues.

5. Keep Copies: Always make copies of the completed form for your records. This can be invaluable for future reference.

6. Deadlines Matter: Pay attention to any deadlines associated with the form. Late submissions can have serious consequences.

7. Seek Help if Needed: If you're unsure about any part of the form or the process, don't hesitate to reach out for assistance. It's better to ask than to risk errors.

Misconceptions

Misconceptions about the Minnesota Lg214 form can lead to confusion. Understanding the facts can help clarify its purpose and requirements. Here are five common misconceptions:

- The Lg214 form is only for large businesses. This form is applicable to various types of entities, including small businesses and non-profits. Size does not limit its use.

- Filing the Lg214 is optional. In many cases, submitting this form is a requirement for compliance with state regulations. Failing to file can lead to penalties.

- Only the CEO can sign the form. While the CEO typically signs, a designated representative may also be authorized to sign on their behalf. It's essential to check the specific requirements.

- The Lg214 form is only relevant during tax season. This form may be necessary at various times throughout the year, depending on your business activities and changes in status.

- Once filed, the information on the Lg214 form cannot be changed. Updates can be made if there are changes to your business information. It's crucial to keep your records current.

Additional PDF Templates

Dealer License Mn - The license application process includes thorough verification of the provided information.

For those interested in vehicle transactions, understanding the Motor Vehicle Power of Attorney process can significantly streamline their efforts. This document empowers an individual to undertake various vehicle-related activities, ensuring all actions are executed in compliance with Alabama regulations.

Mn Ignition Interlock Forms - It is beneficial to ask DVS any questions prior to submitting the form.