Blank Minnesota Lg220 Template

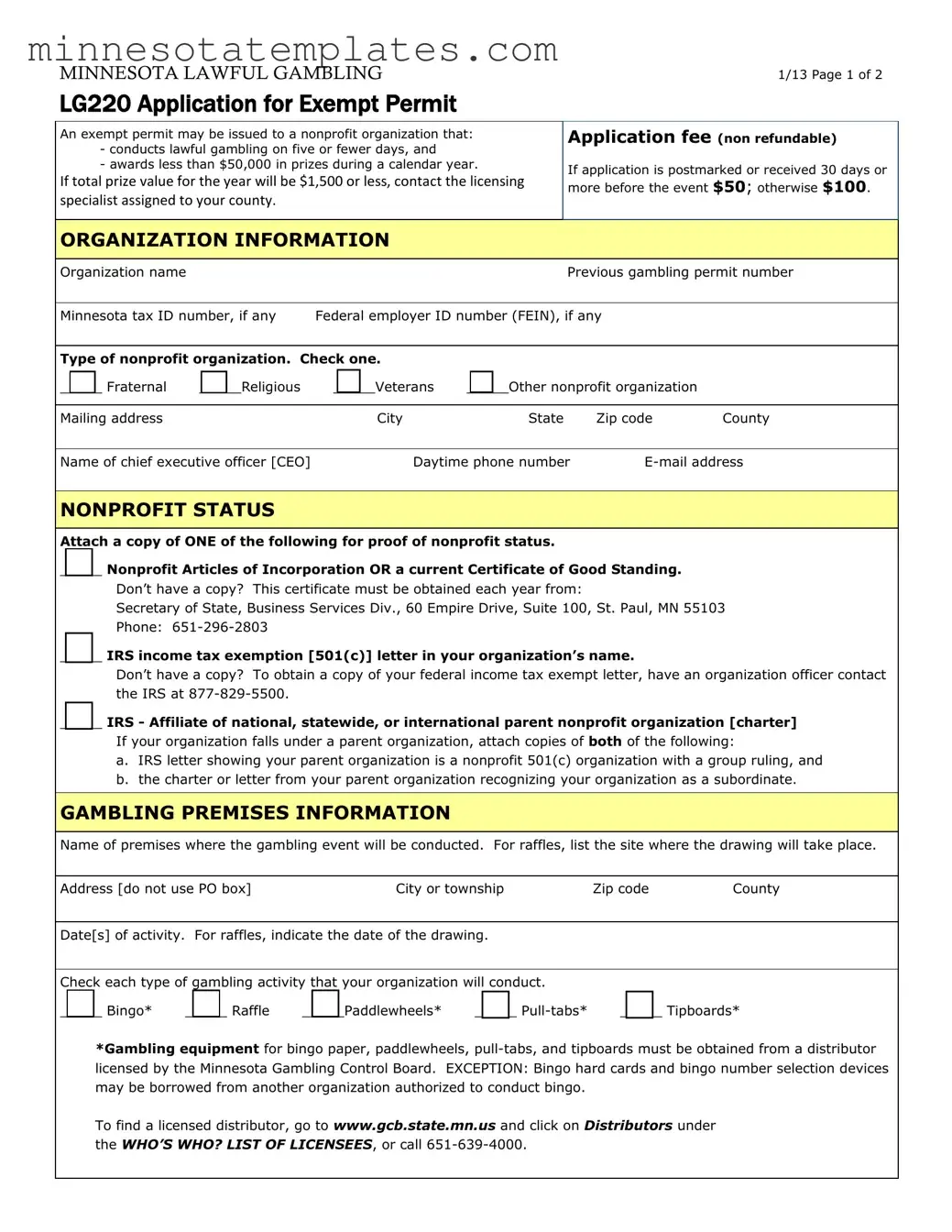

The Minnesota LG220 form is a crucial document for nonprofit organizations looking to conduct lawful gambling events. This form is specifically designed for groups that plan to operate gambling activities on five or fewer days within a calendar year and intend to award less than $50,000 in total prizes. To initiate the process, organizations must submit an application fee, which is non-refundable and varies based on the total prize value. Organizations must provide essential details, including their name, tax ID numbers, and proof of nonprofit status, such as articles of incorporation or IRS exemption letters. Additionally, the form requires information about the premises where the gambling will take place, the types of gambling activities planned, and the dates of these events. Local government acknowledgment is also necessary, as city or county officials must sign off on the application. This ensures compliance with local regulations. Finally, organizations must commit to submitting a financial report to the Gambling Control Board within 30 days of the event date, further ensuring transparency and accountability in their operations.

Key takeaways

When filling out and using the Minnesota LG220 form for an exempt permit, consider the following key takeaways:

- Eligibility Criteria: The form is intended for nonprofit organizations that conduct gambling activities on five or fewer days and award less than $50,000 in prizes during a calendar year.

- Application Fees: The application fee is $50 if the total prize value for the year will be $50,000 or less. If the prize value exceeds this amount, the fee increases to $100.

- Proof of Nonprofit Status: Organizations must attach documentation proving their nonprofit status, such as Articles of Incorporation or an IRS income tax exemption letter.

- Timely Submission: Applications must be submitted at least 30 days prior to the event. Additionally, a financial report must be submitted to the Gambling Control Board within 30 days after the event.

Misconceptions

- Exempt permits are only for large organizations. Many believe that only large nonprofit organizations can apply for an exempt permit. In reality, smaller nonprofits can qualify if they meet specific criteria.

- Any type of gambling can be conducted with an exempt permit. This is incorrect. The permit is limited to certain types of gambling activities, such as raffles and bingo, as specified in the application.

- The application fee is refundable. Some individuals assume that the application fee can be refunded if the permit is denied. However, the fee is non-refundable regardless of the outcome.

- Proof of nonprofit status is optional. It is a common misconception that providing proof of nonprofit status is not necessary. In fact, this documentation is required to complete the application process.

- All gambling events require a separate application. Many people think that every gambling event needs its own application. In truth, only one application is needed for multiple raffle drawings conducted on the same day.

- City and county approvals are not necessary. Some may believe that local government approvals are not needed for the application. However, acknowledgment from the local unit of government is a crucial part of the process.

- Financial reports are not required. There is a misconception that financial reporting is optional. In reality, a financial report must be submitted within 30 days of the event date.

- The Gambling Control Board issues permits immediately. Some applicants expect immediate approval. However, the process may involve waiting periods, especially in certain cities.

- All information on the application is public. While the organization’s name and address become public, other details remain private until a permit is issued or denied.

Additional PDF Templates

How to Get a Work Permit in Mn - Individuals convicted of certain misdemeanors may face additional restrictions.

The Maryland Quarterly Contribution Report form is essential for employers in Maryland to ensure compliance with state regulations regarding Unemployment Insurance contributions. By utilizing this form, employers can accurately report their quarterly wages and contributions, thereby fulfilling their obligations to the State of Maryland's Department of Labor, Licensing and Regulation. For further assistance, you can access the Maryland Quarterly Contribution Report form to simplify the process of completion and submission.

Self Employment Tax Mn - Instructions and details on filling out the M4Np form are included for clarity and compliance.