Blank Minnesota M1 Template

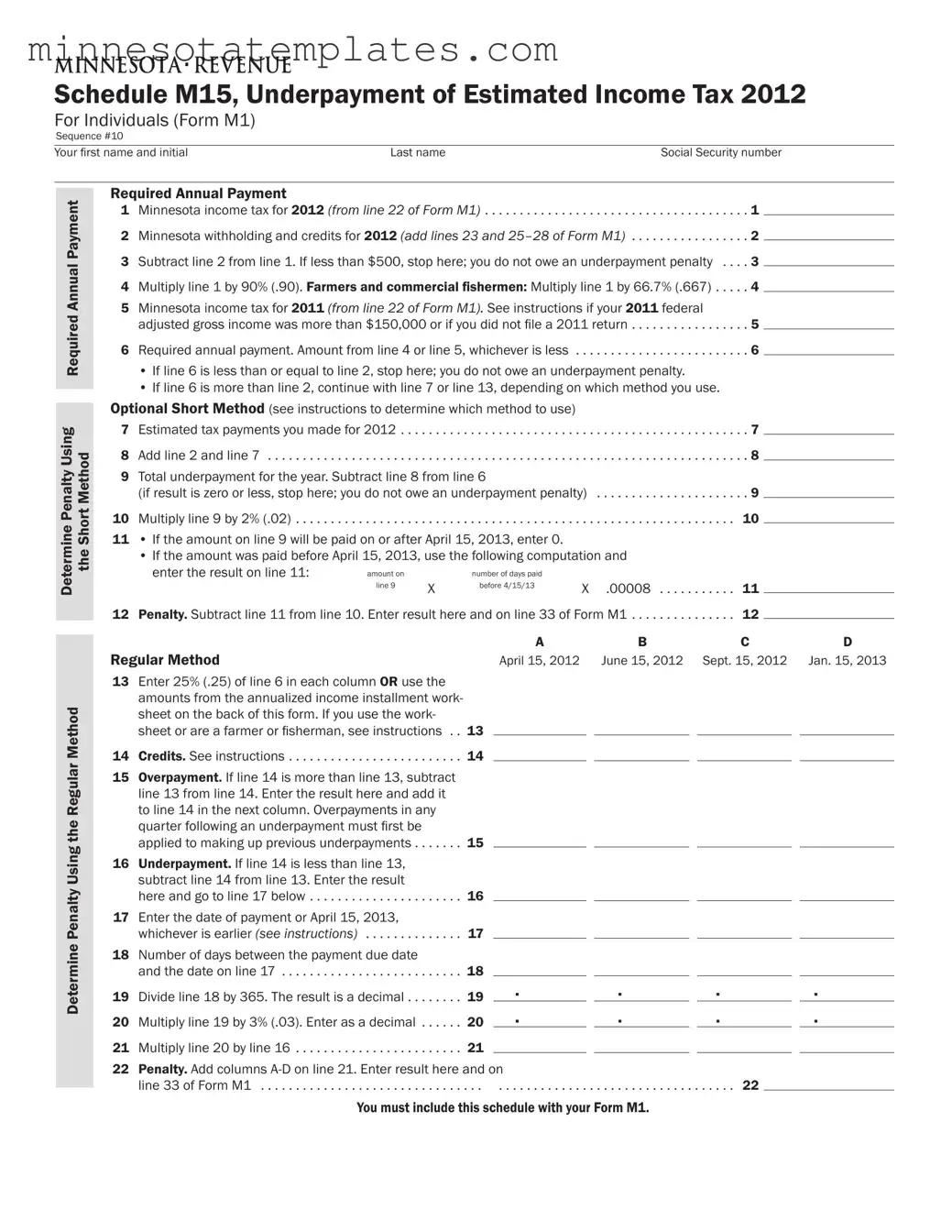

The Minnesota M1 form is a critical document for individuals filing their state income taxes. It serves as the primary tax return for residents, allowing them to report their income, claim deductions, and calculate their tax liability. One important aspect of the M1 form is the Schedule M15, which specifically addresses the underpayment of estimated income tax. This schedule helps taxpayers determine if they owe a penalty for not paying enough tax throughout the year. To assess potential penalties, individuals must consider their total Minnesota income tax, any withholding or credits applied, and the required annual payment based on previous tax liabilities. The form offers two methods for calculating penalties: the optional short method and the regular method, providing flexibility depending on individual circumstances. Additionally, specific guidelines exist for farmers and commercial fishermen, along with exceptions that may apply based on unique situations. Understanding the nuances of the Minnesota M1 form is essential for ensuring compliance and avoiding unnecessary penalties.

Key takeaways

The Minnesota M1 form is essential for individuals to report their income and calculate any taxes owed. It is crucial to fill it out accurately to avoid penalties.

To determine if you owe an underpayment penalty, first assess your total Minnesota income tax for the year. If your tax liability after withholding and credits is $500 or more, you may need to complete Schedule M15.

Use either the Optional Short Method or the Regular Method to calculate your underpayment penalty. The method you choose can significantly impact the penalty amount.

If you are a farmer or commercial fisherman, special rules apply. You may avoid the underpayment penalty if you paid your entire tax by March 1, 2013, or two-thirds by January 15, 2013.

To avoid penalties in the future, ensure you make timely estimated tax payments. Aim to pay at least 90% of your current year's tax liability or 100% of the previous year's liability, with specific adjustments for high-income earners.

Nonresidents and part-year residents should calculate their required annual payment based on their Minnesota assignable adjusted gross income. This ensures that the tax owed aligns with their residency status.

Always include Schedule M15 with your Form M1 if you determine that an underpayment penalty applies. Accurate reporting will help avoid further complications with tax authorities.

Misconceptions

When it comes to the Minnesota M1 form, there are several misconceptions that can lead to confusion. Here’s a look at ten of those common myths and the truths behind them.

- Only high-income earners need to worry about the M1 form. This is not true. Anyone with a Minnesota tax liability can be subject to penalties, regardless of their income level.

- You only need to file the M1 form if you owe taxes. Not necessarily. Even if you don’t owe taxes, you may still need to file to report your income and any applicable credits.

- The M1 form is only for full-year residents. This is a misconception. Part-year residents and nonresidents also have to file if they have Minnesota income tax liability.

- If I didn’t file last year, I don’t have to file this year. This is incorrect. Each tax year is independent. If you have a tax obligation this year, you must file the M1 form regardless of last year's filing status.

- Estimated tax payments are optional. This is misleading. If you expect to owe $500 or more in Minnesota tax, you are generally required to make estimated payments.

- I can ignore penalties if I pay my tax later. This is not the case. Penalties may still apply even if you pay your taxes after the due date.

- Farmers and commercial fishermen are exempt from the M1 form. While there are special provisions for them, they still must file if they have a tax liability.

- Using the optional short method is always better. This is a misconception. In some cases, using the regular method may result in a lower penalty.

- All credits can be applied to the M1 form. Not all credits are applicable. Only certain credits can reduce your tax liability, and it’s essential to check which ones qualify.

- Once I submit the M1 form, I’m done. This is misleading. Keep records of your submission and any correspondence with the Minnesota Department of Revenue, as they may contact you for further information.

Understanding these misconceptions can help you navigate the Minnesota M1 form more confidently. Always stay informed and consult resources or professionals if you're uncertain about your tax obligations.

Additional PDF Templates

Minnesota Sales Tax Filing - Contact information for the Minnesota Department of Revenue is included for any inquiries related to the process.

The Maryland Quarterly Contribution Report form is essential for employers to ensure compliance with state regulations, allowing them to report Unemployment Insurance contributions and wages effectively. If you're seeking guidance on how to navigate this process, you can find resources to help you, including the Maryland Quarterly Contribution Report form, which is crucial for accurate reporting.

Mn Notary Rules - Each component of the form must be completed accurately to avoid delays.