Blank Minnesota M1X Template

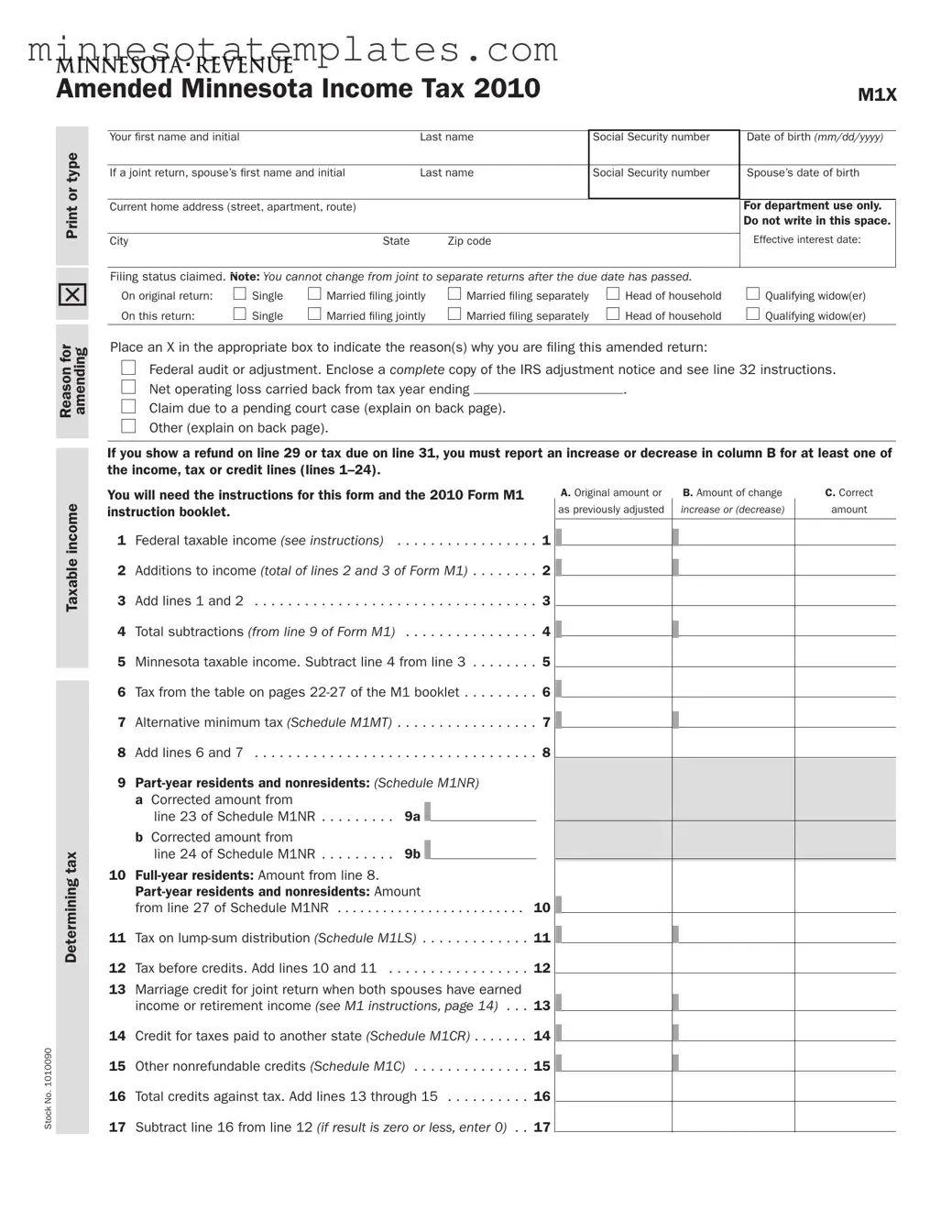

The Minnesota M1X form serves as a crucial tool for individuals looking to amend their 2010 Minnesota income tax return. This form allows taxpayers to correct errors or make updates to their original filings, ensuring that their tax records accurately reflect their financial situation. Key aspects of the M1X include the ability to adjust taxable income, report changes resulting from federal audits, and claim refunds or additional taxes owed. Taxpayers must provide personal details, including names, Social Security numbers, and addresses, while also specifying their filing status. The form requires individuals to indicate the reasons for amending their return, such as federal adjustments or net operating losses. Additionally, it guides users through the process of calculating changes in income, tax credits, and ultimately, any tax due or refund expected. Completing the M1X involves careful attention to detail, as it necessitates referencing previous tax documents and following specific instructions to ensure accurate reporting. By facilitating necessary amendments, the M1X helps maintain the integrity of Minnesota's tax system and supports taxpayers in meeting their obligations.

Key takeaways

- The Minnesota M1X form is specifically designed to amend the 2010 Minnesota individual income tax return.

- Individuals must file this form to correct errors or make changes to their original 2010 Form M1.

- Filing status cannot be changed from married filing jointly to married filing separately after the original due date, which was April 18, 2011.

- If the IRS adjusts a federal return affecting the Minnesota return, the amended form must be filed within 180 days.

- Net operating losses can be reported using the M1X form, with specific rules regarding carrybacks and carryforwards.

- To claim a refund, the M1X must be filed within 3½ years of the original due date of the return.

- Any required schedules or forms must be enclosed with the M1X, particularly if changes affect reported amounts.

- Refunds can be directly deposited into a bank account if the correct routing and account numbers are provided on the form.

Misconceptions

- Misconception 1: The M1X form can be used for any tax year.

- Misconception 2: Filing the M1X allows you to change your filing status after the due date.

- Misconception 3: You do not need to provide supporting documents when filing the M1X.

- Misconception 4: There is no deadline for filing the M1X.

- Misconception 5: You can file the M1X for someone else without any additional paperwork.

This is incorrect. The Minnesota M1X form is specifically designed to amend the 2010 Minnesota individual income tax return. It cannot be used for other tax years.

This is misleading. Once the due date has passed, you cannot change your filing status from married filing jointly to married filing separately. This restriction applies to all taxpayers.

In fact, you must include supporting documents. If you are amending your return due to an IRS adjustment, a complete copy of the federal Form 1040X or the correction notice is required. Failing to provide necessary documents can delay processing.

This is not true. To claim a refund, you must file the M1X within 3½ years of the original due date of the return you are amending. If you owe additional tax, the same deadline applies.

This is incorrect. If you are filing the M1X for another taxpayer, you must include a Power of Attorney form or a court appointment that authorizes you to represent that taxpayer.

Additional PDF Templates

What Grants Are Available for College Students - This form is designed to reduce duplication of effort in grant applications across various funders.

The Maryland Quarterly Contribution Report form is essential for employers to effectively manage and report their Unemployment Insurance contributions. To ensure compliance with state regulations, it's important to familiarize yourself with the requirements of this form. For further details and guidance on the submission process, you can refer to the Maryland Quarterly Contribution Report form.

Counter Offers - This form allows the buyer or seller to propose changes to an existing offer.