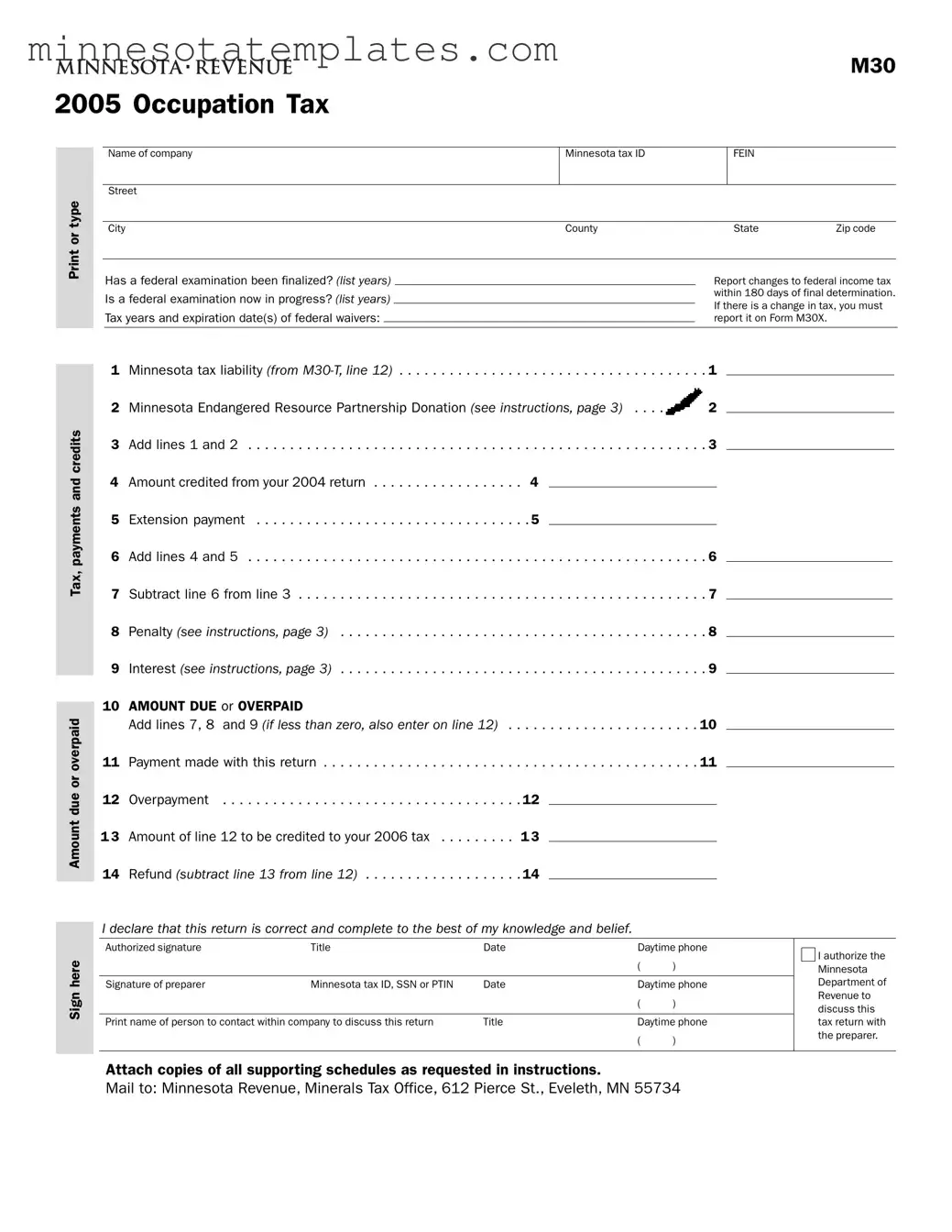

Blank Minnesota M30 Template

The Minnesota M30 form is a crucial document for businesses operating in the state, primarily used to report occupation tax liabilities. This form requires companies to provide essential information, such as their Minnesota tax ID, federal employer identification number (FEIN), and contact details. It also includes sections for reporting any federal examinations, changes to federal income tax, and the status of ongoing examinations. The M30 form outlines the calculation of Minnesota tax liability, incorporating various components like income, deductions, and credits. Taxpayers must detail their gross income, costs, and any adjustments to arrive at the final taxable income. Additionally, the form accounts for penalties and interest, ensuring that all amounts due or overpaid are accurately reported. A signature from an authorized representative is required, affirming the correctness of the information provided. The completed form must be submitted to the Minnesota Department of Revenue, along with any necessary supporting documentation, to maintain compliance with state tax regulations.

Key takeaways

Here are some key takeaways about filling out and using the Minnesota M30 form:

- Accurate Information: Ensure that all company details, including the Minnesota tax ID and FEIN, are correctly entered to avoid processing delays.

- Federal Examination: Indicate if a federal examination has been finalized or is in progress. This information is crucial for accurate tax reporting.

- Tax Liability Calculation: Calculate your Minnesota tax liability using the M30-T attachment. This includes your net income, apportionment factor, and any applicable deductions.

- Supporting Documentation: Attach all required supporting schedules as specified in the instructions. This helps validate your tax return.

- Payment and Refunds: Be clear about any payments made with the return or overpayments. Indicate how you want to handle any overpayment, whether as a credit for the next year or as a refund.

- Signature Requirement: An authorized signature is necessary to validate the return. Make sure to include the title and date of the signature.

- Mailing Instructions: Send the completed form and any attachments to the correct address: Minnesota Revenue, Minerals Tax Office, 612 Pierce St., Eveleth, MN 55734.

Misconceptions

Misconceptions about the Minnesota M30 form can lead to confusion and potential errors in tax reporting. Here are ten common misconceptions, along with clarifications:

- The M30 form is only for large corporations. In reality, the M30 form is applicable to various businesses, including smaller entities that meet certain criteria.

- Filing the M30 form is optional. This is incorrect. Businesses that meet the filing requirements must submit the M30 form to comply with Minnesota tax laws.

- All businesses must report the same information on the M30 form. Each business may have different reporting requirements based on their specific financial situation and tax liabilities.

- There is no penalty for late filing. This is a misconception. Late filing can result in penalties and interest, which can increase the amount owed.

- Overpayments are automatically refunded. While overpayments can lead to refunds, they must be explicitly claimed on the form. Failure to do so may delay or prevent a refund.

- Changes in federal income tax do not affect the M30 form. Changes in federal income tax must be reported on the M30 form, as they can impact state tax liabilities.

- The M30 form can be filed without supporting documentation. This is not true. Supporting documents are often required to substantiate the figures reported on the M30 form.

- Once submitted, the M30 form cannot be amended. In fact, businesses can amend the M30 form using Form M30X if errors or changes are identified after submission.

- Payments can be made at any time without consequences. Payments should be made by the due date to avoid penalties and interest on any outstanding amounts.

- The M30 form is the same as federal tax forms. This is misleading. The M30 form is specific to Minnesota and has unique requirements that differ from federal tax forms.

Additional PDF Templates

Ordained Minister Mn - Ordination allows you to solemnize civil marriages in Minnesota.

For those navigating vehicle transactions, understanding the legal parameters is crucial. Our guide includes the necessary Motor Vehicle Power of Attorney process overview that facilitates the transfer of authority and ensures compliance with state regulations.

Temporary Fuel Permits - The application must include the name and contact phone number of the individual submitting the request.