Blank Minnesota M4Np Template

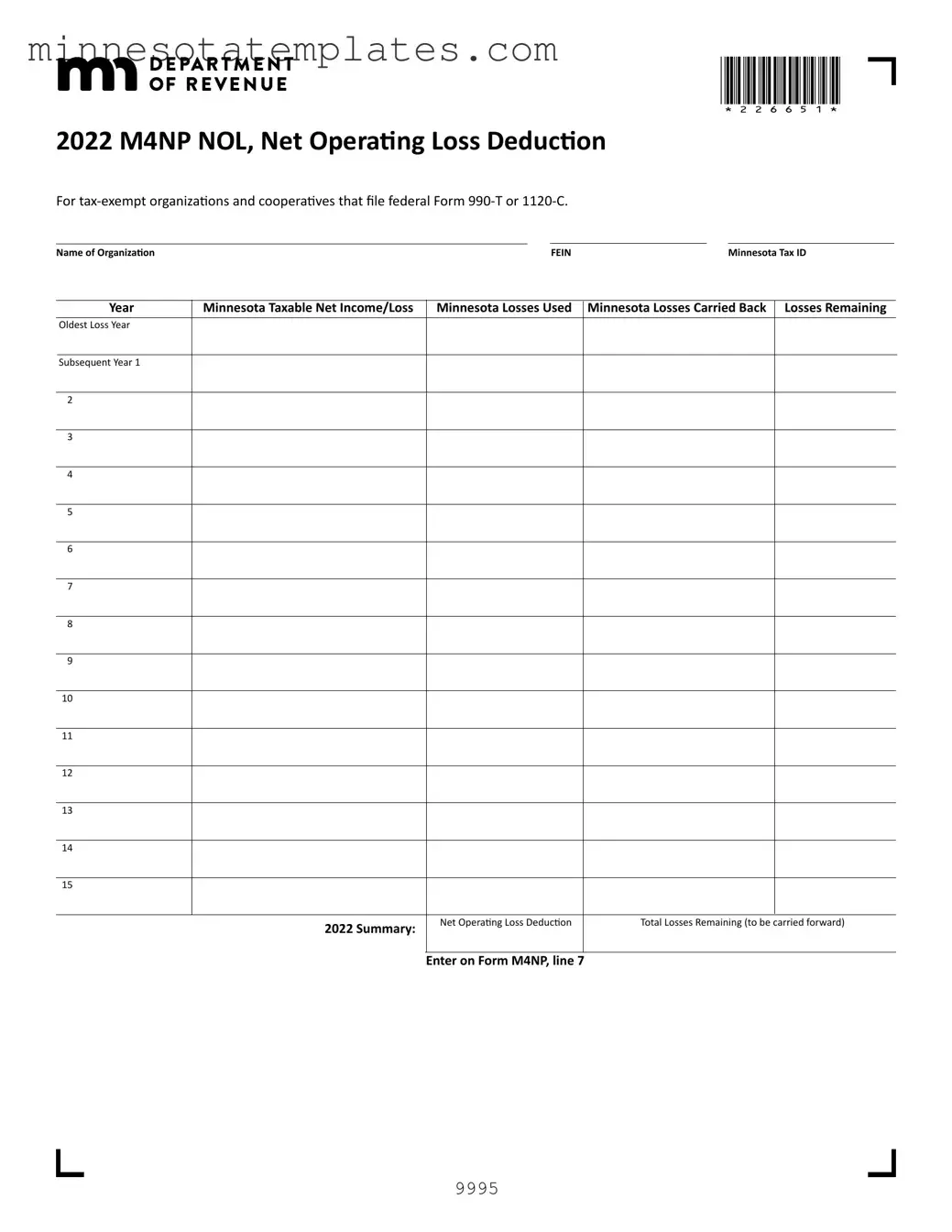

The Minnesota M4Np form plays a crucial role for tax-exempt organizations and cooperatives that must file federal Form 990-T or 1120-C. This form is specifically designed to detail the net operating loss (NOL) deduction, a vital aspect of tax reporting for eligible entities. It requires organizations to provide essential information such as their name, federal employer identification number (FEIN), and Minnesota Tax ID. Additionally, it tracks the Minnesota taxable net income or loss, along with any losses used, carried back, or remaining for future use. Understanding the limitations of the NOL deduction is important; for instance, organizations can only deduct 80% of their taxable net income for the year. Moreover, net operating losses can only be carried forward for a maximum of 15 years. Since tax years beginning after December 31, 2017, the option to carry back losses has been eliminated. Completing this form accurately is vital, as it not only affects tax calculations but also ensures compliance with state regulations. Organizations conducting business solely in Minnesota can deduct the full amount of any previously unused net operating loss after applying the 80% limitation, while those that apportion income must adhere to specific guidelines based on their apportionment percentage. Each corporation in a unitary group must submit a separate Schedule M4NP NOL to claim their deductions effectively.

Key takeaways

Filling out and using the Minnesota M4Np form requires careful attention to detail. Here are four key takeaways to keep in mind:

- Understand the Purpose: This form is specifically for tax-exempt organizations and cooperatives that file federal Form 990-T or 1120-C. It helps document your net operating losses (NOL) and how they can be applied.

- Limitations on Deductions: Your net operating loss deduction is capped at 80% of your taxable net income for the year. It's crucial to apply this limitation correctly to avoid potential issues with your tax return.

- Carry Forward Rules: You can carry forward net operating losses for up to 15 years. Unlike previous years, the two-year carry back option has been eliminated for tax years starting after December 31, 2017.

- Separate Schedules Required: If you are part of a unitary group, each corporation must complete a separate Schedule M4NP NOL to claim its net operating loss deduction. This ensures that each entity's losses are accurately reported and accounted for.

Misconceptions

- Misconception 1: The M4Np form can be used to create or increase net operating losses.

- Misconception 2: All organizations can claim a net operating loss deduction.

- Misconception 3: Losses can be carried back indefinitely.

- Misconception 4: The 80% limitation on net operating loss deductions does not apply if the organization has a loss.

This is not true. The M4Np form does not allow organizations to create or increase net operating losses through deductions such as dividends received or foreign royalties. The form is strictly for reporting existing losses and how they are applied.

Not all organizations qualify. Only tax-exempt organizations and cooperatives that file federal Form 990-T or 1120-C can use the M4Np form to claim a net operating loss deduction. Organizations filing Form 1120-H or 1120-POL are specifically excluded.

This is incorrect. For tax years beginning after December 31, 2017, the two-year carryback option has been eliminated. Organizations can only carry forward their net operating losses for up to 15 years.

This is a misunderstanding. The 80% limitation applies regardless of whether the organization has a loss or income for the year. Organizations can only deduct up to 80% of their taxable net income using net operating losses from previous years.

Additional PDF Templates

Mn Charitable Gambling - The Minnesota LG214 form encourages good management practices.

For those navigating the complexities of sales tax refunds, the ST-12B Georgia form is essential, and resources such as Forms Georgia can provide invaluable assistance, ensuring that all necessary details about the transaction and dealer are accurately compiled to facilitate a smoother refund experience for Georgia taxpayers.

Bankruptcy Minnesota - Separate classes for unsecured creditors can be established in Section 10.