Blank Minnesota New Hire Reporting Template

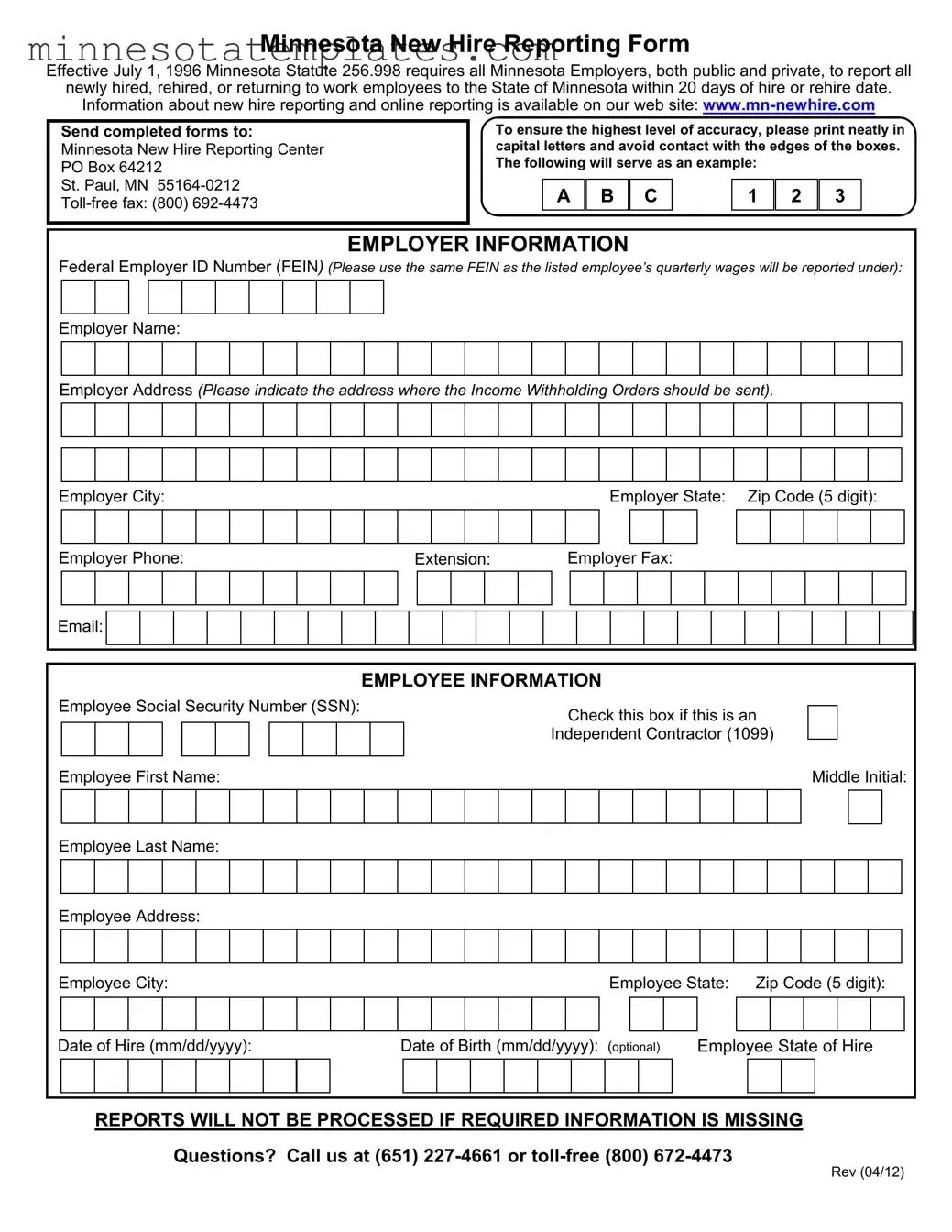

The Minnesota New Hire Reporting Form is a critical tool for employers across the state, designed to streamline the process of reporting newly hired or rehired employees. Since its implementation on July 1, 1996, under Minnesota Statute 256.998, all employers—both public and private—are mandated to submit this form within 20 days of an employee's hire or rehire date. This requirement not only helps in tracking employment but also plays a vital role in child support enforcement and the prevention of fraud. The form collects essential information, including the employer's Federal Employer ID Number (FEIN), contact details, and the employee's Social Security Number (SSN), among other personal data. To ensure accuracy, employers are advised to fill out the form neatly in capital letters and to avoid any contact with the edges of the designated boxes. For convenience, the Minnesota New Hire Reporting Center provides various resources, including an online reporting option, and can be reached for questions via phone. Completed forms can be sent to the designated address in St. Paul, or faxed toll-free, ensuring that employers have multiple avenues for compliance.

Key takeaways

Here are some key takeaways regarding the Minnesota New Hire Reporting form:

- Mandatory Reporting: All employers in Minnesota must report newly hired, rehired, or returning employees within 20 days of their hire date.

- Who Needs to Report: This requirement applies to both public and private employers.

- Accurate Information: Ensure that all information is filled out accurately. Use capital letters and avoid touching the edges of the boxes.

- Submission Method: Completed forms can be sent via mail or fax to the Minnesota New Hire Reporting Center.

- Federal Employer ID Number: Use the same Federal Employer ID Number (FEIN) that will be reported for the employee's quarterly wages.

- Independent Contractors: If the employee is an independent contractor, check the appropriate box on the form.

- Contact Information: If you have questions, you can reach out to the reporting center at the provided phone numbers.

Misconceptions

Understanding the Minnesota New Hire Reporting form is essential for employers in the state. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- Only private employers need to report new hires. This is incorrect. Both public and private employers in Minnesota are required to report newly hired, rehired, or returning employees.

- Reporting is optional if the employee is part-time. In reality, all new hires, regardless of their employment status, must be reported within 20 days of their hire date.

- Employers can report new hires at any time. This is misleading. Employers must submit reports within a strict 20-day timeframe to comply with state law.

- The form can be submitted electronically without any issues. While electronic submission is allowed, it is crucial to ensure that all required information is accurately filled out. Incomplete forms will not be processed.

- Only the employee's Social Security Number is required. This is not true. Employers must provide various details, including the Federal Employer ID Number and employee information, to complete the report.

- Independent contractors do not need to be reported. This is a misconception. If an independent contractor is classified as a 1099 employee, they still need to be reported on the form.

- The Minnesota New Hire Reporting Center processes reports immediately. In fact, processing times may vary, and reports will not be processed if any required information is missing.

- Only the employer's address is needed on the form. This is incorrect. The form requires both employer and employee addresses to ensure accurate communication and processing.

- There are no penalties for late reporting. This is misleading. Employers may face penalties for failing to report new hires within the designated timeframe, emphasizing the importance of timely compliance.

Employers should familiarize themselves with these facts to ensure compliance with Minnesota's New Hire Reporting requirements. Accurate and timely reporting not only fulfills legal obligations but also supports the state's efforts in child support enforcement and other important initiatives.

Additional PDF Templates

Minnesota Ec04 - If needed, employees can request an interpreter for hearings by noting the required language.

Mp 9018 - Understanding the consequences of trespassing can deter potential violations.

For those navigating the intricacies of tax refunds in Georgia, the ST-12B Georgia form is an essential resource, and more information can be found at Forms Georgia. This affidavit allows purchasers to claim a refund on sales tax paid, necessitating specific details about both the transaction and the dealer. By familiarizing oneself with the form's components and requirements, taxpayers can enhance their refund process efficiency.

Minnesota Tax Forms 2022 - It is essential to enclose copies of any required schedules and amended returns as needed.