Blank Minnesota St101 Template

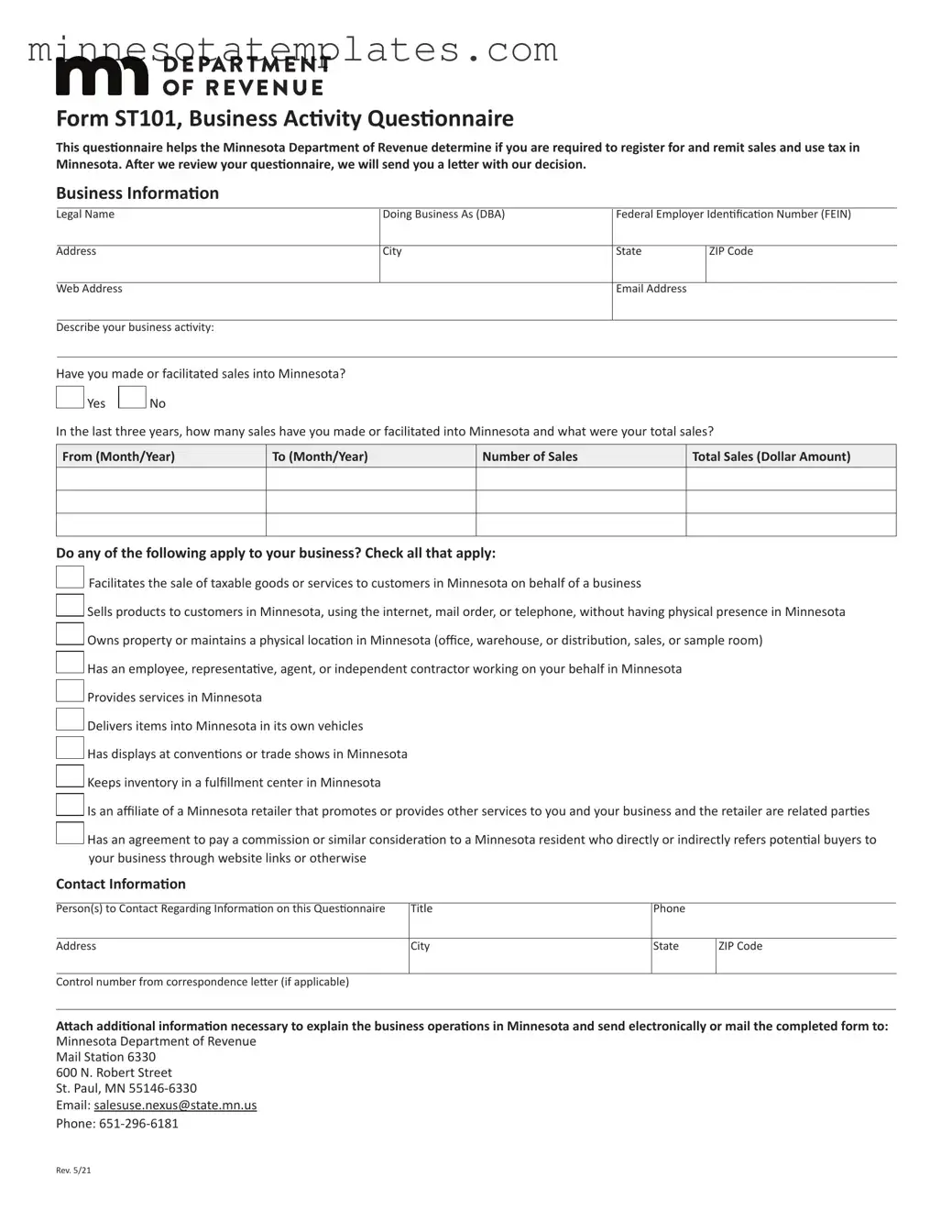

The Minnesota ST101 form, officially known as the Business Activity Questionnaire for Determining Sales Tax Nexus, serves a crucial purpose for businesses operating within or engaging with the state. This form is designed to help the Minnesota Department of Revenue assess whether a business has established a tax presence, or nexus, in Minnesota. To complete the ST101, businesses must provide detailed information about their operations, including legal names, federal employer identification numbers, and the nature of their business activities. The form requires businesses to disclose their sales activities, including whether they sell products or services to Minnesota consumers, and if they have any employees or offices in the state. Additionally, it asks about previous business names, ownership structures, and any marketing efforts directed at Minnesota residents. By thoroughly answering these questions, businesses can ensure compliance with state tax laws and avoid potential penalties. Completing the ST101 is not just a bureaucratic requirement; it is an essential step in understanding a business's tax obligations in Minnesota.

Key takeaways

- Complete All Sections: Ensure that every section of the Minnesota ST101 form is filled out accurately. Missing information can delay processing or lead to complications.

- Attach Required Documents: Include a copy of your most recent annual report with your submission. This is necessary for verification purposes.

- Be Honest and Thorough: Answer all questions truthfully. If additional explanations are needed, use extra sheets as required to clarify your responses.

- Understand Your Nexus: The form helps determine your sales tax nexus in Minnesota. Familiarize yourself with the criteria to ensure compliance and avoid penalties.

Misconceptions

Misconceptions about the Minnesota ST101 Form

- 1. The ST101 form is only for large businesses. This form applies to all businesses that engage in activities in Minnesota, regardless of size.

- 2. Filing the ST101 form is optional. If your business has a sales tax nexus in Minnesota, completing this form is mandatory to comply with state tax laws.

- 3. The ST101 form is only about sales tax. While it does address sales tax, it also covers various business activities that may create a tax obligation in Minnesota.

- 4. You can submit the ST101 form without supporting documents. It is essential to attach your most recent annual report and any additional sheets needed to explain your answers.

- 5. The ST101 form is a one-time requirement. Businesses must update and resubmit the form whenever there are significant changes in their operations or nexus status.

- 6. You can file the ST101 form online. Currently, the form must be submitted via mail or fax to the Minnesota Department of Revenue.

- 7. Completing the ST101 form guarantees no tax liability. Filing the form does not exempt your business from tax obligations. It simply helps determine your nexus status.

Additional PDF Templates

Mn Permit to Carry Renewal Online Class - This form is active as of June 12 and may be updated periodically.

The ST-12B Georgia form is an essential document for individuals pursuing a refund of sales tax on their purchases, and it complements resources available on sites such as Forms Georgia. This affidavit is intended to support the purchaser's claim and requires specific details regarding the transaction as well as the dealer involved. By familiarizing themselves with its components and requirements, taxpayers in Georgia can effectively navigate the refund process.

Dealer License Mn - The sign must be legible from nearby streets during daylight hours.