Blank Minnesota Template

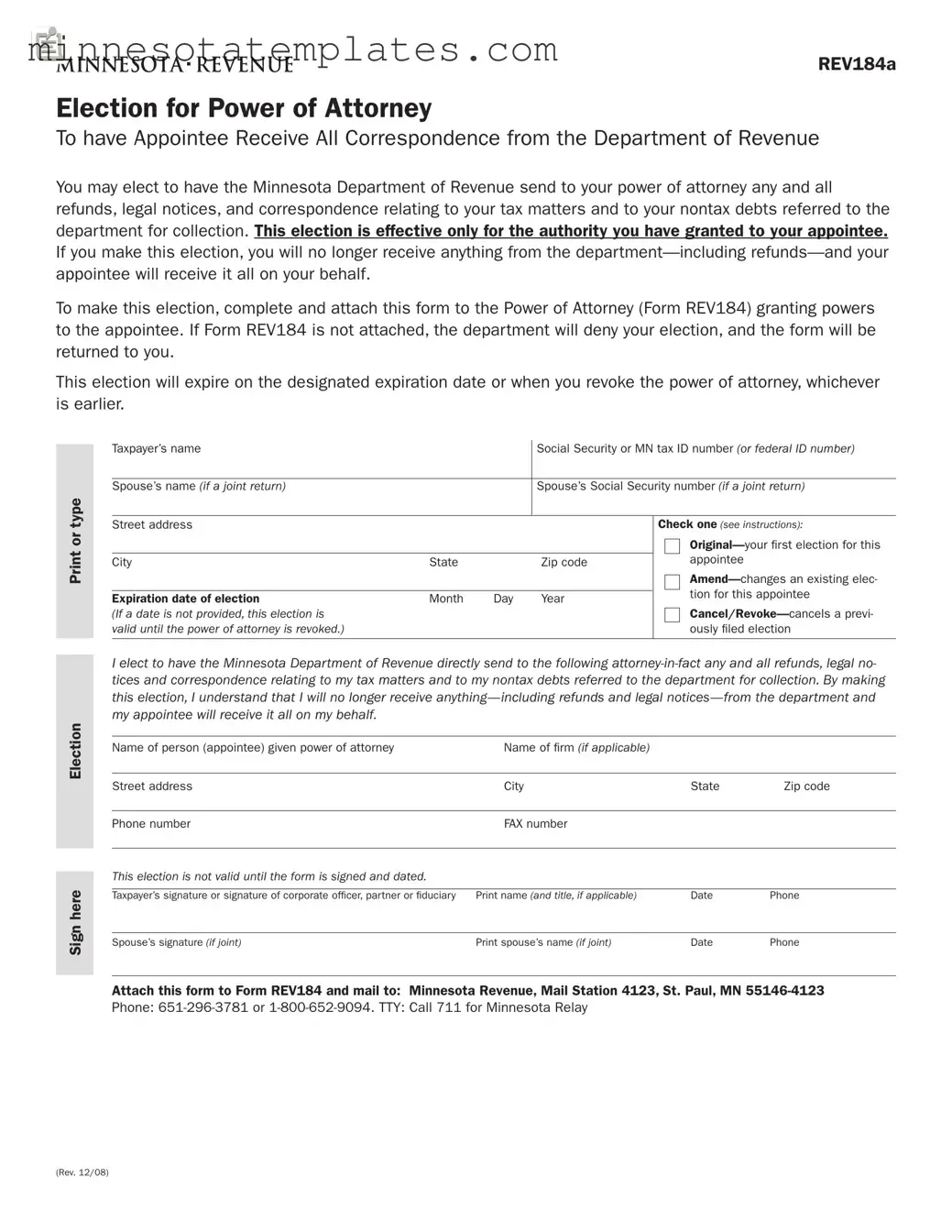

The Minnesota form REV184a is an important document for individuals seeking to streamline their communication with the Minnesota Department of Revenue. This form allows taxpayers to appoint someone, known as an appointee or attorney-in-fact, to receive all correspondence, including refunds and legal notices, related to their tax matters and non-tax debts. By completing this election, taxpayers will no longer receive direct communication from the department, as all correspondence will be directed to their appointed representative. To initiate this process, it is essential to complete the form and attach it to the Power of Attorney (Form REV184). If the Power of Attorney form is not included, the election will be denied and returned. The election remains valid until a specified expiration date or until the power of attorney is revoked, whichever comes first. The form requires basic information, such as the taxpayer's name, Social Security number, and details about the appointee. It also includes options to indicate whether this is an original election, an amendment, or a cancellation of a previous election. Proper signatures and dates are necessary for the election to be valid. Once completed, the form should be mailed to the Minnesota Department of Revenue for processing.

Key takeaways

When filling out the Minnesota form REV184a for appointing a power of attorney, consider the following key takeaways:

- Understand the Purpose: This form allows your appointee to receive all correspondence from the Minnesota Department of Revenue regarding your tax matters and nontax debts.

- Impact of the Election: By electing this option, you will no longer receive any communications or refunds directly from the department.

- Attach Required Documents: Always attach this form to the Power of Attorney (Form REV184). Without it, your election will be denied.

- Expiration of Election: The election remains effective until the designated expiration date or until you revoke the power of attorney.

- Complete All Fields: Ensure you fill in all necessary information, including names, addresses, and Social Security numbers.

- Choose the Correct Option: Indicate whether this is an original election, an amendment, or a cancellation of a previous election.

- Signatures Required: The form must be signed and dated by you, and by your spouse if filing jointly.

- Mailing Instructions: Send the completed form to the designated address: Minnesota Revenue, Mail Station 4123, St. Paul, MN 55146-4123.

Following these steps will help ensure that your election is processed smoothly and that your appointee can effectively manage your tax correspondence.

Misconceptions

Understanding the Minnesota form REV184a can be challenging, and several misconceptions often arise. Here are seven common misunderstandings about this form:

- Only tax-related matters are covered. Many believe that this form only pertains to tax issues. However, it also includes nontax debts referred to the department for collection.

- Once I submit the form, it cannot be changed. This is not true. You can amend your election by submitting an amended form. Just make sure to indicate the changes clearly.

- I will still receive copies of all correspondence. In fact, if you elect to have your appointee receive all correspondence, you will no longer receive any notifications or refunds directly from the Department of Revenue.

- The election lasts indefinitely. This misconception can lead to confusion. The election is only valid until the designated expiration date or until you revoke the power of attorney.

- My spouse's signature is always required. The spouse's signature is only necessary if you are filing a joint return. If you are filing individually, it is not required.

- I can submit this form without attaching Form REV184. This is incorrect. The election will be denied if you do not attach the Power of Attorney form (REV184) granting powers to your appointee.

- Once I appoint someone, I cannot change my mind. You can revoke your power of attorney at any time, which will also cancel the election to have correspondence sent to your appointee.

By clarifying these misconceptions, individuals can better navigate the process of appointing a power of attorney in Minnesota and ensure they make informed decisions regarding their tax matters.

Additional PDF Templates

Minnesota Tax Form - All companies filing the M30 must indicate any overpayments or amounts due based on their calculations.

For those who need clarity during a vehicle transaction, the comprehensive Motor Vehicle Bill of Sale documentation is vital. This form not only acts as tangible proof of the sale but also safeguards the interests of both the buyer and seller throughout the process. To explore more about this form, review our detailed guide on the Motor Vehicle Bill of Sale requirements.

Dealer License Mn - Dealers must confirm they comply with local zoning regulations.

Mn Ticket Lookup - The submitted form assists in protecting access to justice for all.