Valid Operating Agreement Form for the State of Minnesota

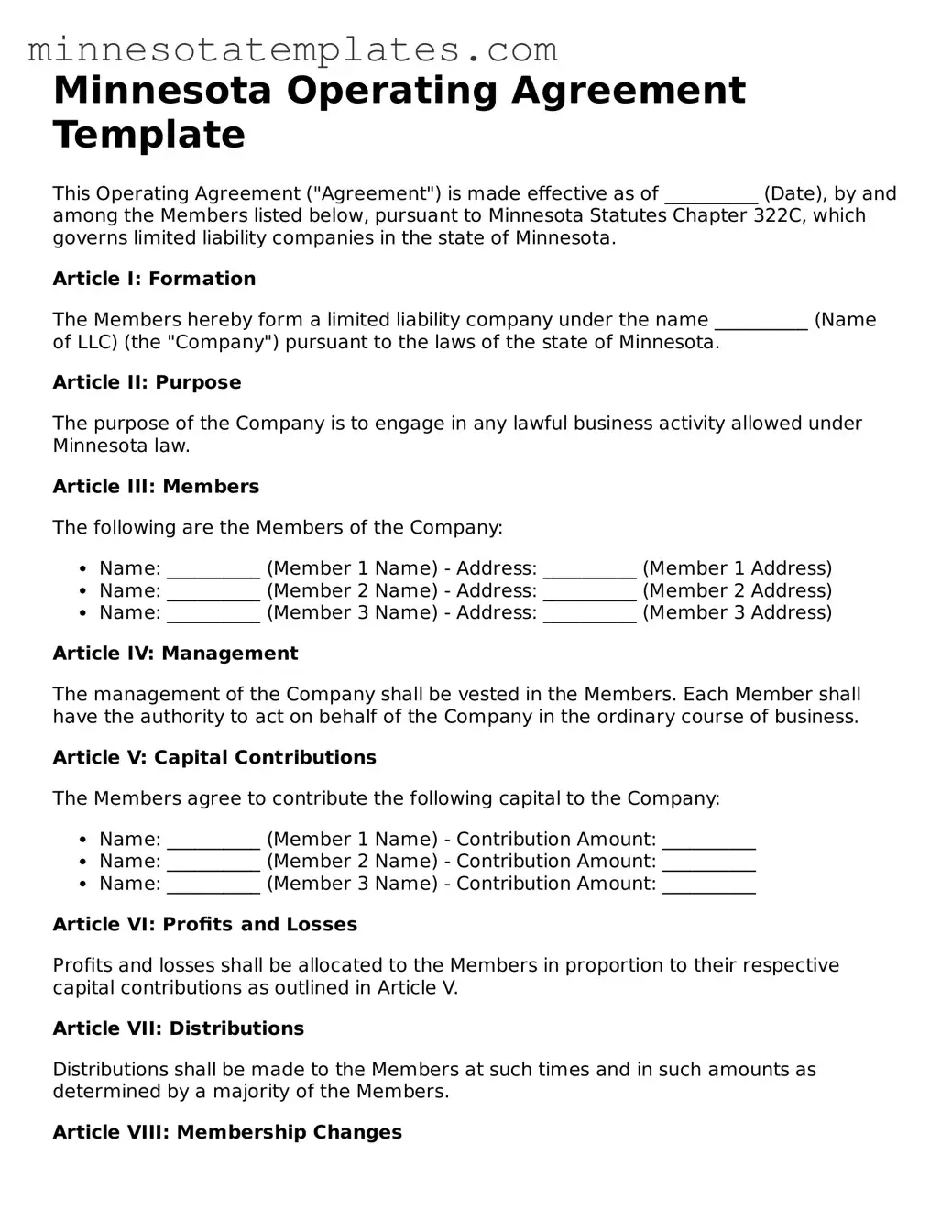

The Minnesota Operating Agreement form serves as a foundational document for limited liability companies (LLCs) operating in the state. This essential agreement outlines the management structure, responsibilities of members, and operational procedures, ensuring clarity and consistency in business operations. By addressing key aspects such as profit distribution, decision-making processes, and member rights, the form helps prevent misunderstandings and disputes among stakeholders. Additionally, it can include provisions for adding or removing members, handling member disputes, and outlining procedures for dissolving the LLC if necessary. In a state where businesses thrive on clear guidelines, having a well-structured Operating Agreement is not just beneficial; it is a crucial step toward establishing a successful enterprise.

Key takeaways

Here are some key takeaways about filling out and using the Minnesota Operating Agreement form:

- The Operating Agreement outlines the management structure of your LLC.

- It is important to include the names and addresses of all members.

- Define the roles and responsibilities of each member clearly.

- Specify how profits and losses will be distributed among members.

- Decide on the process for making decisions, including voting rights.

- Include provisions for adding or removing members in the future.

- Address how disputes will be resolved among members.

- Ensure that the agreement complies with Minnesota state laws.

- Keep a signed copy of the Operating Agreement with your business records.

Misconceptions

Here are ten common misconceptions about the Minnesota Operating Agreement form, along with clarifications for each:

- It is not necessary for all LLCs. Some people believe that an operating agreement is optional for all LLCs. However, it is highly recommended, as it outlines the management structure and operating procedures.

- It must be filed with the state. Many think that the operating agreement needs to be submitted to the state. In reality, it is an internal document that stays with the LLC and does not require filing.

- All members must sign it. Some assume that every member must sign the operating agreement for it to be valid. While it’s best practice for all members to sign, the agreement can still be enforceable even without every signature.

- It cannot be changed once created. A common belief is that once an operating agreement is established, it cannot be modified. In fact, members can amend the agreement as needed, following the procedures outlined within it.

- It covers only financial matters. Some people think the operating agreement only deals with finances. However, it also addresses management roles, decision-making processes, and member responsibilities.

- It is the same as the Articles of Organization. Many confuse the operating agreement with the Articles of Organization. The former details internal operations, while the latter is a formal document filed with the state to establish the LLC.

- It is only necessary for multi-member LLCs. Some believe that single-member LLCs do not need an operating agreement. However, having one is still beneficial for establishing clear guidelines and protecting personal liability.

- It is a one-size-fits-all document. A misconception is that a standard template will work for every LLC. Each business has unique needs, so it’s important to tailor the agreement to fit specific circumstances.

- Legal assistance is not needed. Some think they can draft an operating agreement without any help. While it’s possible, consulting with a legal professional can ensure that all important aspects are covered.

- It has no legal significance. Many underestimate the importance of the operating agreement. It holds legal weight and can be used in court to resolve disputes among members.

Other Common Minnesota Templates

Mn Snowmobile Bill of Sale - This form serves as proof of purchase between the buyer and seller.

The Maryland form plays an essential role in the project approval process, facilitating communication between project initiators and the appropriate preservation authorities. It collects vital information about the project, including descriptions, contact details, and any potential impacts on historic properties. To access and complete this important documentation, refer to the Maryland form, ensuring compliance with both state and federal preservation guidelines.

Minnesota Notary Examples - The presence of a Notary often simplifies complicated transactions.