The Minnesota IG260 form is a tax return specifically designed for surplus lines brokers dealing with nonadmitted insurance. This semiannual statement must be filed even if there are no premiums to report, ensuring compliance with Minnesota tax laws. If you're...

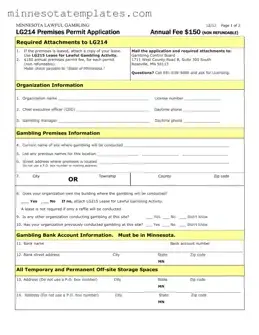

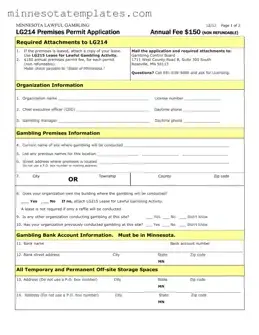

The Minnesota LG214 form is a document used to facilitate specific legal processes within the state of Minnesota. This form is essential for ensuring compliance with state regulations and for the proper documentation of various transactions. If you need to...

The Minnesota LG220 form is an application for an exempt permit that allows nonprofit organizations to conduct lawful gambling activities for a limited number of days each year. This permit is specifically designed for organizations that plan to award less...

The Minnesota M1 form is the state's individual income tax return. It is used by residents to report their income and calculate their tax liability for the year. Understanding how to complete this form is essential for ensuring compliance and...

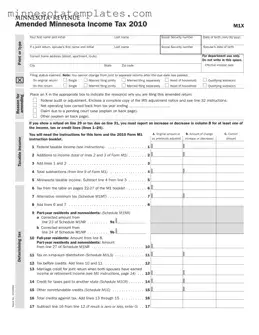

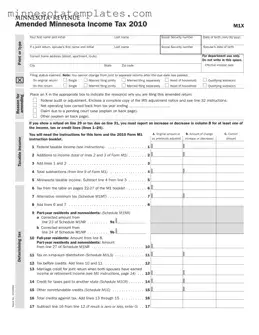

The Minnesota M1X form is designed for individuals who need to amend their original Minnesota individual income tax return for the year 2010. By using this form, taxpayers can correct errors, report changes, or address adjustments resulting from federal audits...

The Minnesota M30 form is a tax document used by businesses to report their Minnesota tax liabilities and any payments or credits. This form captures essential financial details, including income, deductions, and potential overpayments. Understanding how to accurately fill out...

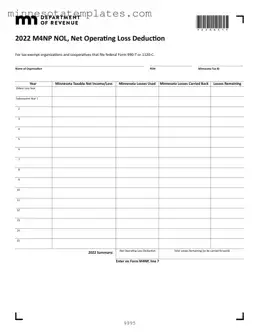

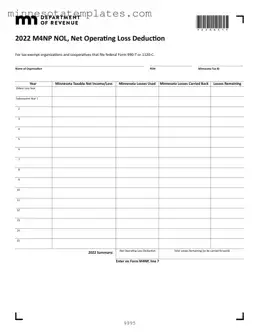

The Minnesota M4Np form is used by tax-exempt organizations and cooperatives to report net operating loss deductions. This form allows entities to detail their Minnesota taxable net income or loss, as well as the application of any net operating losses...

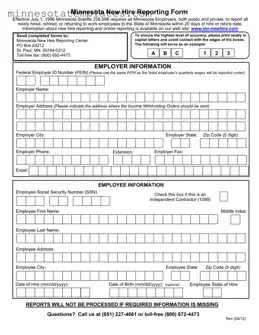

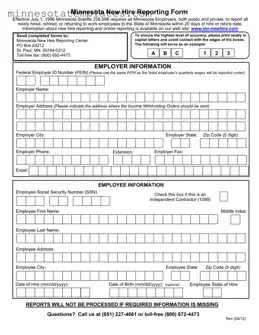

The Minnesota New Hire Reporting Form is a mandatory document that all employers in Minnesota must complete to report newly hired, rehired, or returning employees. Under Minnesota Statute 256.998, this reporting is required within 20 days of the hire or...

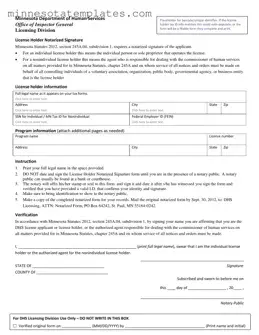

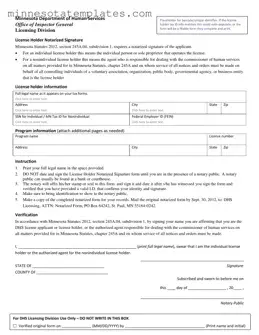

The Minnesota Notarized Form is a document required by the Minnesota Department of Human Services for individuals and organizations seeking a license. This form must include a notarized signature, affirming the identity of the applicant or authorized agent. To ensure...

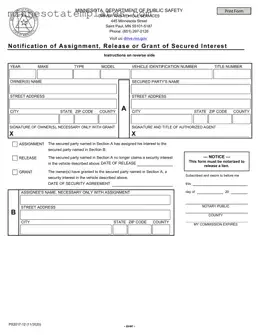

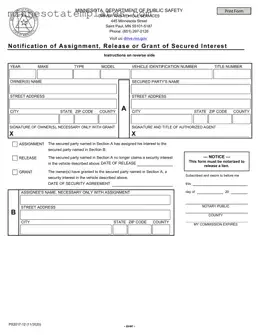

The Minnesota Notification of Assignment form is a crucial document used to notify relevant parties about the assignment, release, or grant of a secured interest in a vehicle. This form ensures that changes in ownership or financial interests are officially...

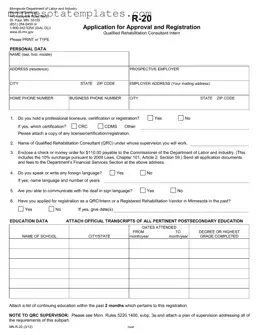

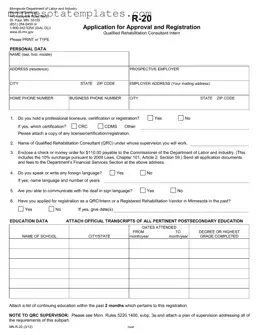

The Minnesota R 20 form is an application for approval and registration as a Qualified Rehabilitation Consultant Intern. This form is essential for individuals seeking to work under the supervision of a Qualified Rehabilitation Consultant (QRC) in Minnesota. Ensure that...

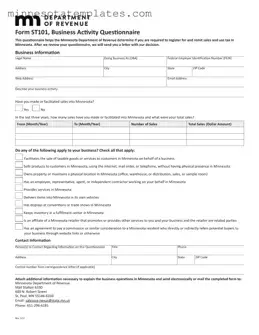

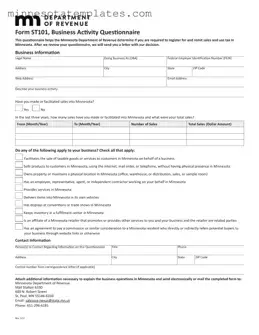

The Minnesota ST101 form is a Business Activity Questionnaire designed to help determine a business's sales tax nexus in Minnesota. This form collects essential information about your business activities, such as sales, employees, and operations within the state. Completing the...