Valid Power of Attorney Form for the State of Minnesota

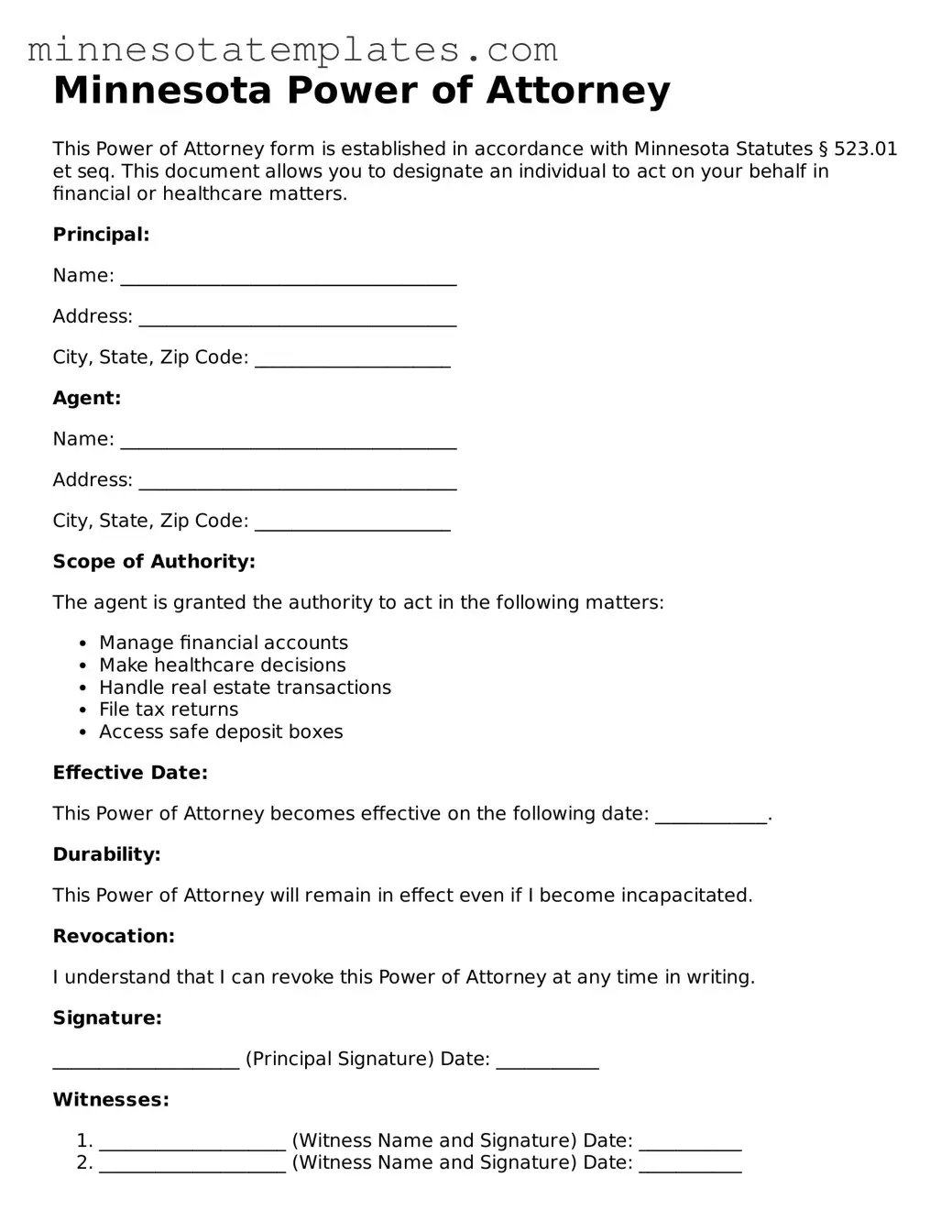

The Minnesota Power of Attorney form is an essential legal document that empowers individuals to designate someone they trust to make decisions on their behalf when they are unable to do so. This form can cover a wide range of financial and health-related decisions, allowing the appointed agent to manage finances, pay bills, and make medical choices. The flexibility of the Minnesota Power of Attorney allows for both general and specific powers, meaning you can grant broad authority or limit it to particular tasks. Additionally, this document can be durable, ensuring that it remains effective even if the principal becomes incapacitated. Understanding the nuances of this form is crucial for anyone looking to safeguard their interests and ensure that their wishes are respected during times of need. By taking the time to complete this form thoughtfully, individuals can provide peace of mind for themselves and their loved ones, knowing that their affairs will be handled according to their preferences. Whether planning for the future or addressing immediate concerns, the Minnesota Power of Attorney form serves as a vital tool in personal and financial planning.

Key takeaways

When filling out and using the Minnesota Power of Attorney form, it’s important to understand several key aspects to ensure that your intentions are clearly communicated and legally recognized. Here are some essential takeaways:

- Choose the Right Agent: Select someone you trust implicitly. Your agent will have significant authority over your financial or medical decisions, depending on the type of Power of Attorney you create.

- Specify Powers Clearly: Clearly outline the powers you wish to grant. This can include handling financial transactions, making healthcare decisions, or managing real estate. Being specific helps avoid confusion later.

- Consider Durability: Decide whether you want your Power of Attorney to be durable. A durable Power of Attorney remains effective even if you become incapacitated, while a non-durable one ceases when you can no longer make decisions.

- Sign and Date Properly: Ensure that you sign and date the form in accordance with Minnesota law. Typically, your signature must be witnessed by at least one person or notarized to be valid.

- Review Regularly: Life changes, and so can your needs. Regularly review your Power of Attorney to ensure it reflects your current wishes and circumstances.

Misconceptions

Many people have misunderstandings about the Minnesota Power of Attorney form. Here are four common misconceptions:

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney is permanent and cannot be revoked.

- Misconception 3: Anyone can be appointed as an agent.

- Misconception 4: A Power of Attorney becomes effective only when I become incapacitated.

This is not true. While many people associate a Power of Attorney with financial decisions, it can also cover healthcare decisions. You can specify whether your agent can make medical choices on your behalf.

This is incorrect. You can revoke a Power of Attorney at any time, as long as you are mentally competent. Simply notify your agent and any institutions that may have a copy of the document.

While you have the freedom to choose your agent, it’s important to select someone trustworthy and capable. The law requires that your agent acts in your best interest, so choose wisely.

This is a common belief, but it depends on how you set it up. You can create a durable Power of Attorney that takes effect immediately or one that activates only upon your incapacity. Clarifying this in the document is essential.

Other Common Minnesota Templates

Form Ps2000 - This form is an essential document for anyone needing help managing vehicle-related tasks.

The California Articles of Incorporation form is a legal document that officially establishes a corporation in the state. It outlines essential information about the business, including its name, purpose, and management structure. If you're ready to start your corporate journey, you can access the Articles of Incorporation form and fill it out by clicking the button below.

How to Homeschool in Minnesota - Parents are encouraged to submit this form by the start of the school year.