Valid Promissory Note Form for the State of Minnesota

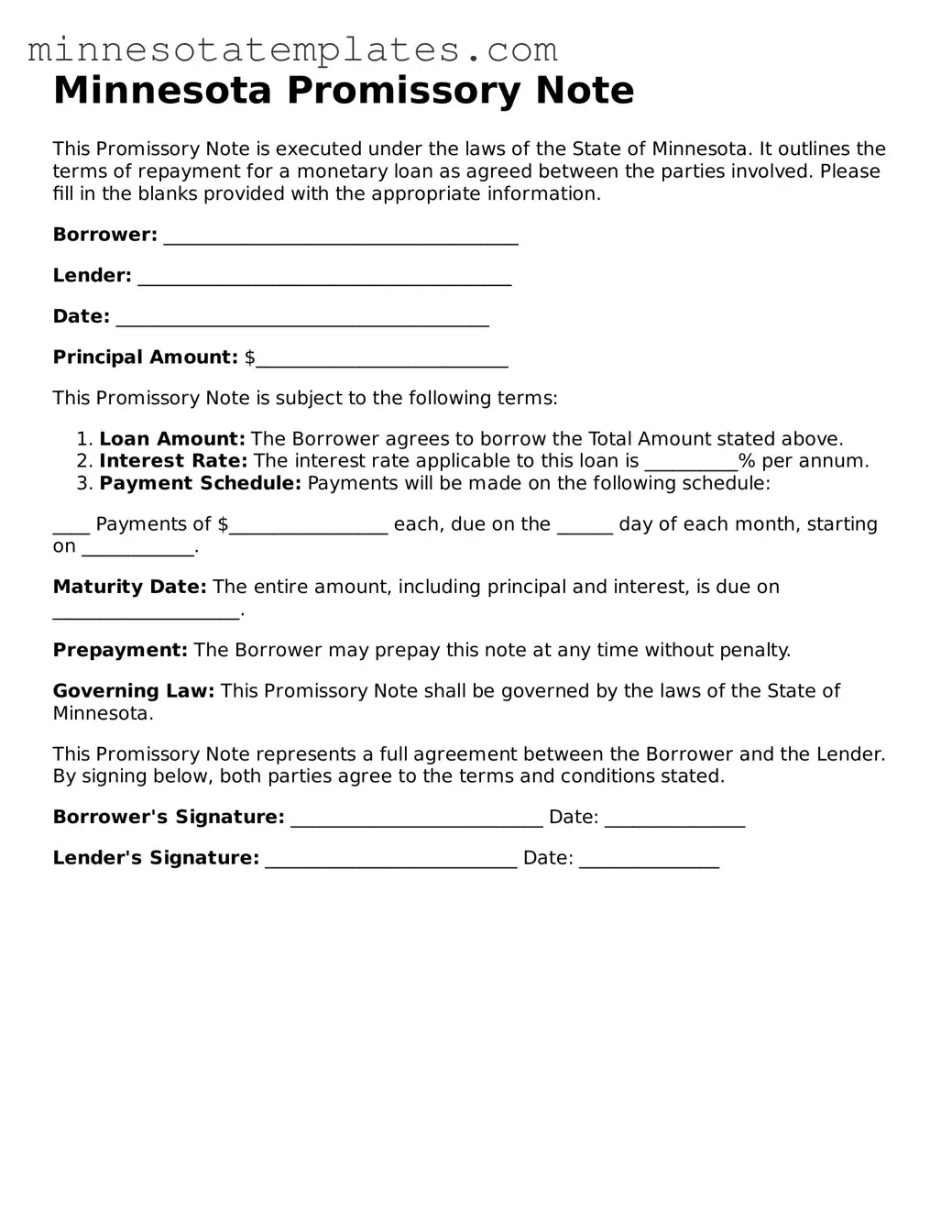

The Minnesota Promissory Note form serves as a crucial instrument in the realm of personal and business finance, facilitating the borrowing and lending of money with clarity and security. This document outlines the borrower's commitment to repay a specified amount to the lender, typically including details such as the principal amount, interest rate, repayment schedule, and any applicable penalties for late payments. It also delineates the rights and responsibilities of both parties, ensuring that expectations are clear from the outset. In Minnesota, the form is designed to comply with state laws, thus providing legal enforceability and protecting the interests of both lenders and borrowers. Whether used for personal loans between friends or more formal agreements between businesses, the Minnesota Promissory Note embodies essential elements such as signatures, dates, and witness requirements, which contribute to its validity and reliability. Understanding the nuances of this form is vital for anyone engaged in lending or borrowing activities, as it lays the groundwork for a transparent financial relationship.

Key takeaways

Ensure all parties involved in the transaction are clearly identified. This includes the borrower and the lender, along with their respective contact information.

The amount of the loan must be explicitly stated in both numerical and written form to avoid any ambiguity.

Specify the interest rate, if applicable. This should include whether it is fixed or variable, and the method of calculation should be clear.

Outline the repayment terms, including the schedule for payments, the due date, and any grace periods.

Both parties should sign and date the document to validate the agreement. Witnesses or notarization may enhance the enforceability of the note.

Misconceptions

When dealing with financial agreements, misunderstandings can arise. The Minnesota Promissory Note form is no exception. Here are five common misconceptions about this important document:

- All promissory notes must be notarized. While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note to be valid in Minnesota. The agreement is enforceable as long as it is signed by the parties involved.

- A promissory note is the same as a loan agreement. Although both documents relate to borrowing money, they serve different purposes. A promissory note is a simple promise to repay a specific amount, while a loan agreement typically includes more detailed terms and conditions, such as interest rates and repayment schedules.

- Promissory notes are only for large loans. This is a misconception. Promissory notes can be used for loans of any size, whether it's a small personal loan between friends or a significant business loan. The key is that there is a clear agreement regarding repayment.

- Once signed, a promissory note cannot be changed. This is not entirely true. While a signed promissory note is a binding agreement, the parties involved can agree to modify the terms. Such changes should be documented in writing and signed by both parties to ensure clarity and enforceability.

- A promissory note does not need to specify a repayment date. This is misleading. While it is possible to create a promissory note without a specific repayment date, doing so can lead to confusion and disputes. It is advisable to include a repayment schedule to avoid misunderstandings.

Understanding these misconceptions can help individuals navigate the complexities of financial agreements more effectively. Clarity in documentation fosters trust and ensures that all parties are on the same page.

Other Common Minnesota Templates

Minnesota Employee Rules - Review guidelines for engaging with clients and external partners.

To effectively manage your affairs, consider utilizing a customized Power of Attorney form that details your intentions and appoints a trusted agent for decision-making on your behalf.

Medical Power of Attorney Mn - Clarify your health care wishes and appoint a trusted agent through this document.

Uniform Conveyancing Blanks - Tax implications may arise from property transactions documented by deeds.