Valid Quitclaim Deed Form for the State of Minnesota

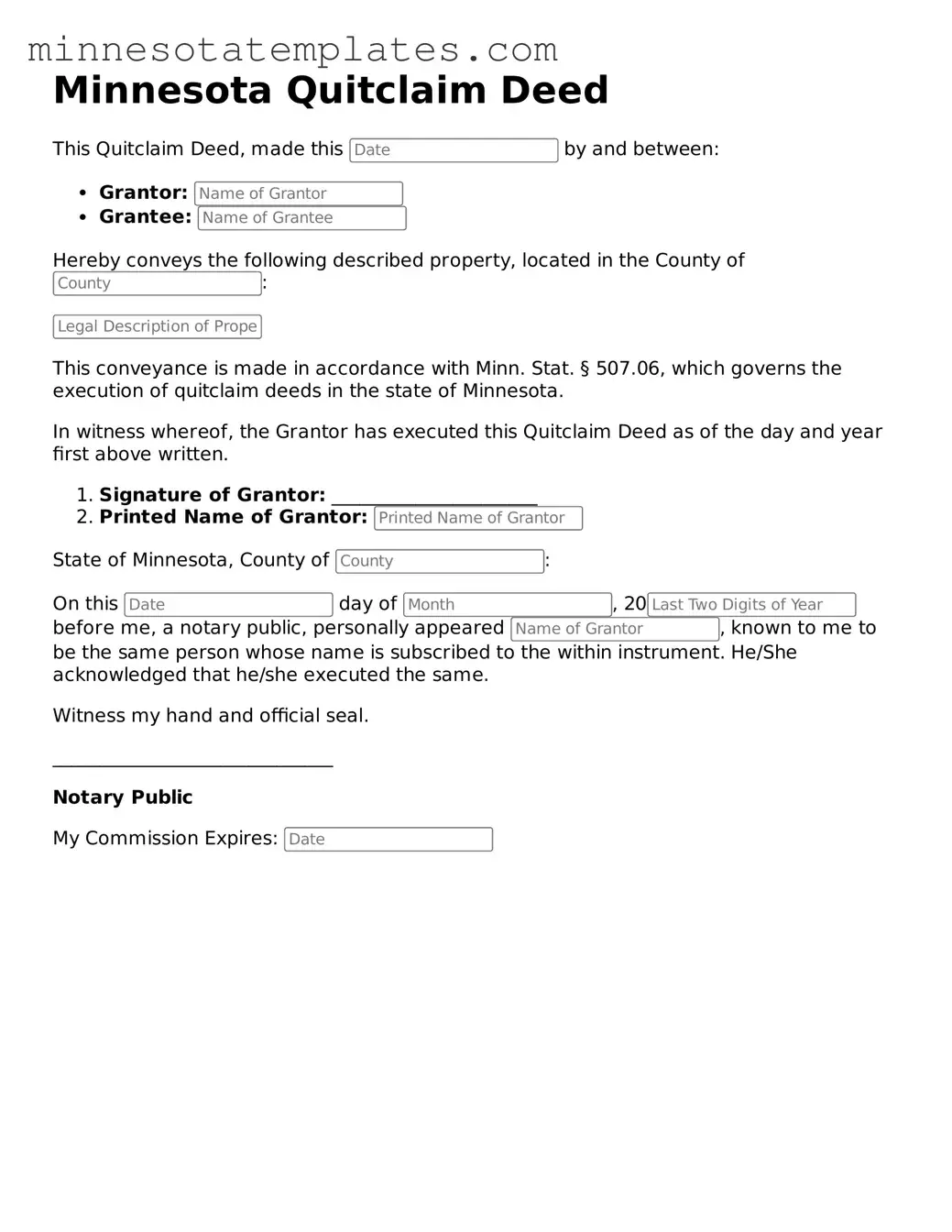

When it comes to transferring property ownership in Minnesota, the Quitclaim Deed serves as a straightforward and efficient tool. This form allows one party, known as the grantor, to relinquish any claim or interest they may have in a piece of real estate to another party, referred to as the grantee. Unlike other types of deeds, the Quitclaim Deed does not guarantee that the grantor holds clear title to the property; instead, it simply conveys whatever interest the grantor possesses, if any. This can be particularly useful in various situations, such as among family members, during divorce proceedings, or when settling estates. The form typically requires essential details, including the names of the parties involved, a legal description of the property, and the date of the transfer. Once completed and signed, the Quitclaim Deed must be filed with the appropriate county office to ensure the change in ownership is officially recorded. Understanding the nuances of this form can empower individuals to navigate property transfers with confidence, making it an invaluable resource for anyone engaged in real estate transactions in Minnesota.

Key takeaways

Filling out and using the Minnesota Quitclaim Deed form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- Understand the purpose: A Quitclaim Deed transfers ownership of property without any guarantees. It’s often used among family members or to clear up title issues.

- Gather necessary information: You will need details about the property, including the legal description, the names of the grantor (seller) and grantee (buyer), and their addresses.

- Complete the form accurately: Fill out the Quitclaim Deed form carefully. Any errors can lead to complications later.

- Sign in front of a notary: Both the grantor and grantee must sign the document in front of a notary public to make it legally binding.

- File with the county: After signing, the Quitclaim Deed must be filed with the county recorder’s office where the property is located.

- Check for fees: Be aware that there may be filing fees when you submit the Quitclaim Deed. Check with your local county office for the exact amount.

- Consider tax implications: Transferring property can have tax consequences. It’s wise to consult a tax professional for guidance.

- Keep a copy: After filing, retain a copy of the Quitclaim Deed for your records. This document proves ownership.

- Consult a lawyer if needed: If you have questions or concerns about the process, seeking legal advice can be beneficial.

Being informed about these steps can help ensure a smooth experience when using the Minnesota Quitclaim Deed form.

Misconceptions

Many individuals have misconceptions about the Minnesota Quitclaim Deed form. Understanding these misconceptions can help clarify the purpose and function of this legal document. Below are five common misunderstandings:

- A Quitclaim Deed Transfers Ownership Completely. While a quitclaim deed does transfer ownership of property, it does not guarantee that the grantor has clear title to the property. The recipient may receive whatever interest the grantor has, which could be none at all.

- Quitclaim Deeds Are Only Used in Divorce Cases. Although quitclaim deeds are often associated with divorce settlements, they can be used in various situations, including transferring property between family members or clearing up title issues.

- A Quitclaim Deed Eliminates All Liens on the Property. This is not accurate. A quitclaim deed does not remove any existing liens or encumbrances on the property. The new owner may still be responsible for any debts tied to the property.

- Quitclaim Deeds Do Not Require Notarization. In Minnesota, quitclaim deeds must be notarized to be valid. This step is essential to ensure the authenticity of the signatures and the document itself.

- Using a Quitclaim Deed is Always the Best Option. While quitclaim deeds are simple and quick, they may not be the best choice in every situation. In cases where a warranty of title is needed, a warranty deed might be more appropriate.

Other Common Minnesota Templates

Dnr Patient - A legal document expressing a person's wishes regarding resuscitation efforts.

Rental Application Form Minnesota - Security deposit requirements are clarified through this section.

The California Articles of Incorporation form is a legal document that officially establishes a corporation in the state. It outlines essential information about the business, including its name, purpose, and management structure. If you're ready to start your corporate journey, fill out the form by clicking the button below. For your convenience, you can access the Articles of Incorporation form online.

Small Estate Affidavit Mn - In some cases, the affidavit can be used to manage the deceased's affairs even before their estate is fully settled.