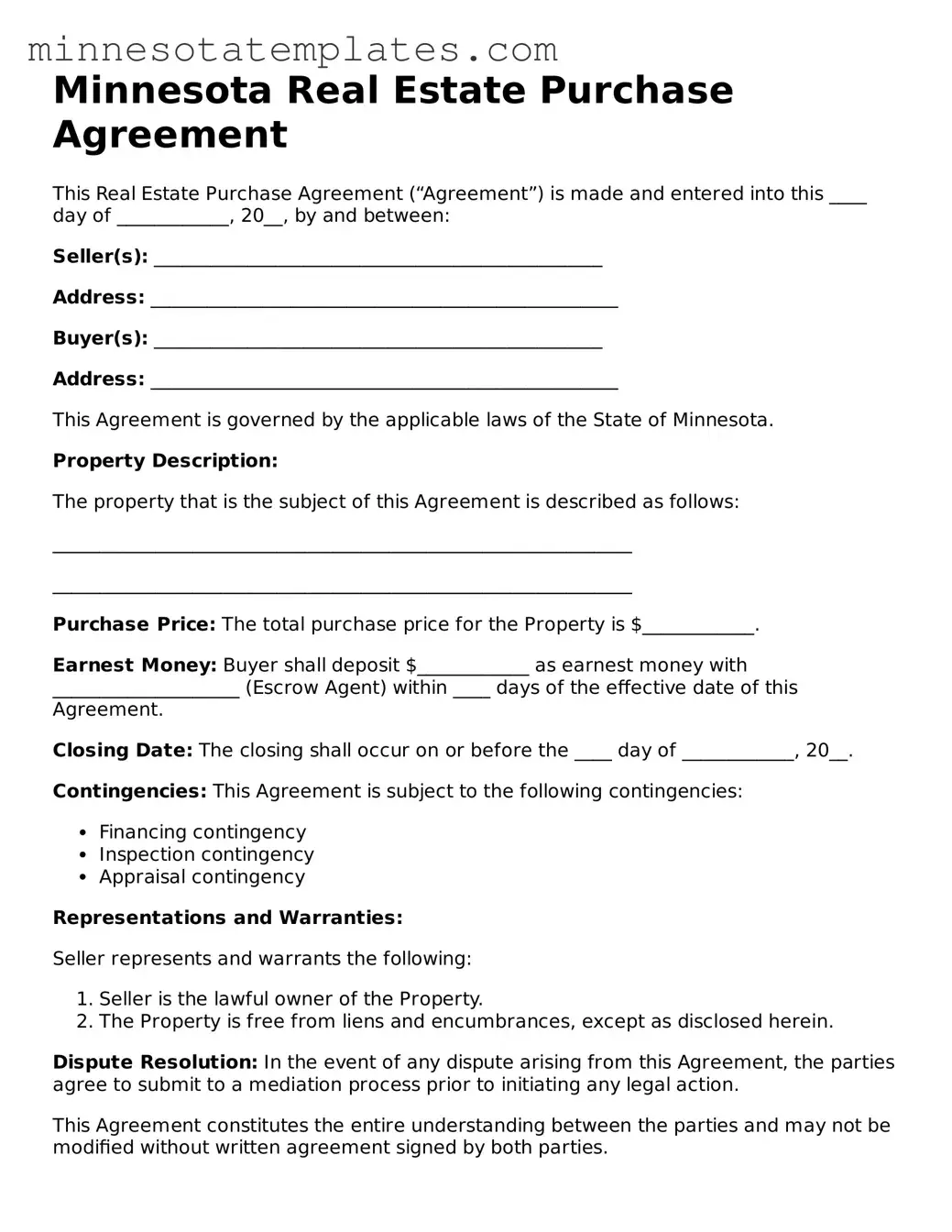

Valid Real Estate Purchase Agreement Form for the State of Minnesota

When navigating the world of real estate transactions in Minnesota, understanding the Minnesota Real Estate Purchase Agreement form is essential for both buyers and sellers. This comprehensive document serves as the foundation of any property sale, detailing critical elements such as the purchase price, financing terms, and the closing date. It outlines the rights and obligations of both parties, ensuring clarity and protection throughout the transaction process. Additionally, the form addresses contingencies, which may include inspections, appraisals, and the buyer's ability to secure financing. By incorporating specific provisions, the agreement can also cover earnest money deposits and any included fixtures or personal property. Understanding these components can help individuals make informed decisions, ultimately leading to a smoother real estate experience.

Key takeaways

When filling out and using the Minnesota Real Estate Purchase Agreement form, there are several important points to keep in mind. Understanding these key takeaways can help ensure a smoother transaction for both buyers and sellers.

- Accuracy is Crucial: Ensure that all information provided in the agreement is accurate. This includes the names of the parties involved, property details, and financial terms. Errors can lead to complications down the line.

- Understand Contingencies: The agreement may include various contingencies, such as financing or inspection clauses. Familiarize yourself with these provisions, as they protect both parties and outline the conditions under which the sale can proceed or be terminated.

- Review Deadlines: The agreement will specify various deadlines for actions such as inspections, financing approval, and closing dates. Adhering to these timelines is essential for a successful transaction.

- Seek Professional Guidance: Consider working with a real estate agent or attorney. Their expertise can provide valuable insights, help navigate the complexities of the agreement, and ensure that your rights are protected throughout the process.

Misconceptions

Understanding the Minnesota Real Estate Purchase Agreement is crucial for anyone involved in buying or selling property. However, several misconceptions can lead to confusion. Here are five common misconceptions:

-

It is a legally binding contract immediately upon signing.

While signing the agreement is a significant step, it does not become legally binding until all parties have signed and any contingencies have been met. This includes obtaining financing or completing inspections.

-

All agreements are the same across the state.

Not all real estate purchase agreements are identical. Variations may exist based on local practices, specific property types, or unique terms negotiated between the parties.

-

Once signed, the terms cannot be changed.

Terms can be modified if both parties agree to the changes. This often happens during negotiations or if unexpected issues arise during the transaction process.

-

The seller must disclose every issue with the property.

Sellers are required to disclose known issues that could affect the property's value or safety. However, they are not obligated to disclose every minor defect.

-

Using a standard form guarantees a smooth transaction.

While using a standard form can help streamline the process, it does not guarantee that all potential issues will be addressed. Each transaction is unique, and careful attention to detail is necessary.

Being informed about these misconceptions can help both buyers and sellers navigate the real estate process more effectively. Always consider consulting a professional for guidance tailored to your specific situation.

Other Common Minnesota Templates

Hennepin Housing Court - Offers clarity in the landlord's intent to terminate tenancy.

How to Homeschool in Minnesota - The letter must be submitted to the appropriate local education office.

For those looking to streamline legal processes, a concise guide on how to properly complete a Power of Attorney form can be invaluable. This document not only empowers an agent with decision-making authority but also ensures your preferences are honored when you are unable to act on your own. Familiarizing yourself with this vital form will enhance your legal preparedness.

Mn Snowmobile Bill of Sale - This document may also indicate if the snowmobile is sold "as is."