Valid Small Estate Affidavit Form for the State of Minnesota

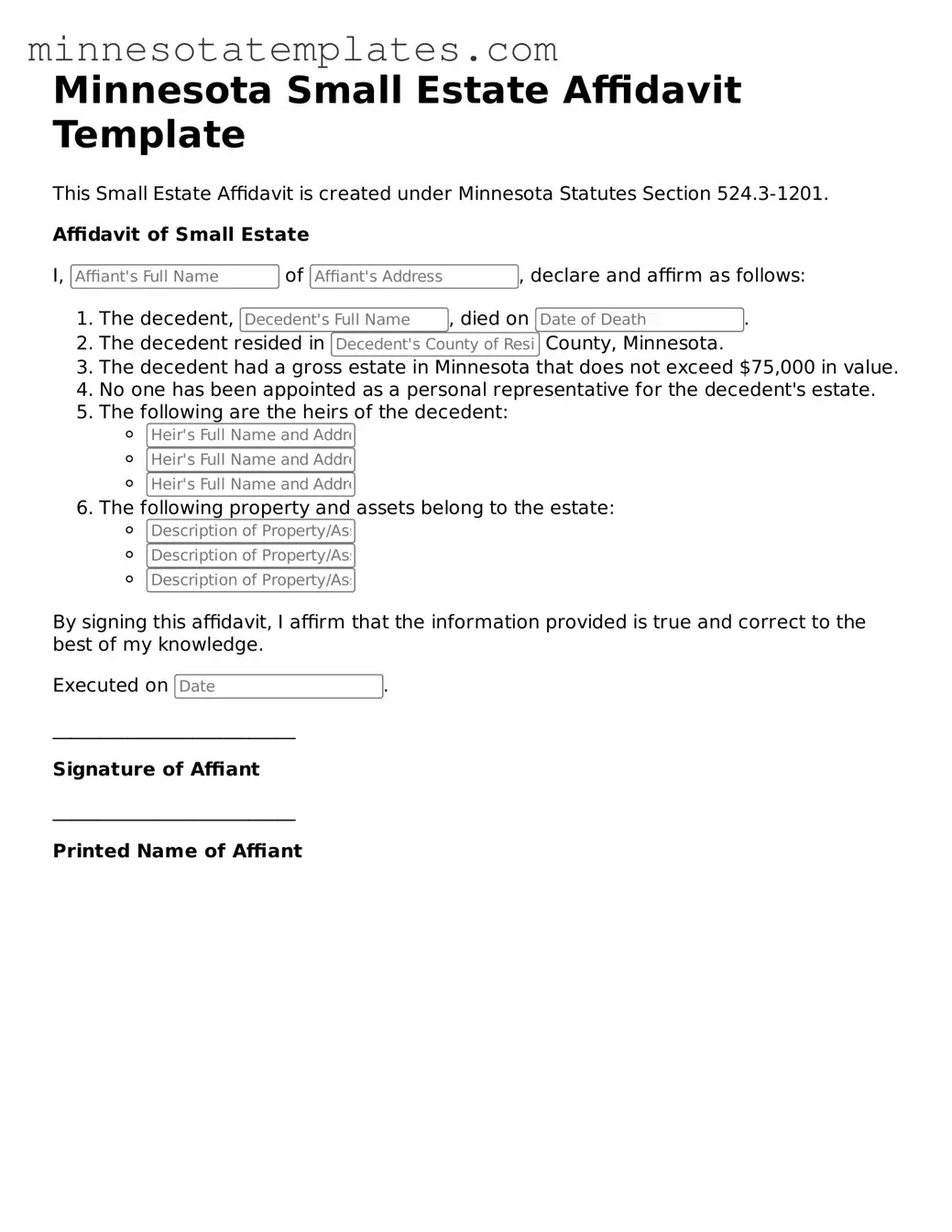

The Minnesota Small Estate Affidavit form serves as a vital tool for individuals managing the estates of deceased loved ones with limited assets. This form simplifies the process of transferring property without the need for formal probate, making it accessible for those who may not have extensive legal knowledge. To qualify, the total value of the estate must fall below a specified threshold, which is determined by state law. The affidavit must be completed and signed by an eligible heir, ensuring that all necessary information is included, such as the deceased's details and a list of assets. Additionally, the form requires the affidavit to be notarized, adding a layer of authenticity. Once properly filled out, it can be presented to financial institutions or other entities holding the deceased’s assets, allowing for a smoother transition of ownership. Understanding the requirements and processes involved with the Small Estate Affidavit can ease the burden during a challenging time, providing a clear path forward for heirs and beneficiaries.

Key takeaways

Filling out and using the Minnesota Small Estate Affidavit form can simplify the process of settling a deceased person's estate when the total value is below a certain threshold. Here are some key takeaways to consider:

- The Small Estate Affidavit is applicable when the total value of the estate, excluding certain assets, is less than $75,000.

- Individuals must be at least 18 years old to file the affidavit, ensuring that they have the legal capacity to act on behalf of the estate.

- The form requires information about the deceased, including their name, date of death, and a description of the assets.

- Affidavits must be signed in the presence of a notary public, which adds a layer of authenticity and legal validation.

- Once completed, the affidavit can be presented to banks, financial institutions, or other entities holding the deceased's assets to facilitate their transfer.

- It is important to ensure that all information provided is accurate and truthful, as any discrepancies could lead to legal complications.

Misconceptions

The Minnesota Small Estate Affidavit is a legal tool designed to simplify the process of transferring assets from a deceased individual without the need for formal probate proceedings. However, several misconceptions surround this form that can lead to confusion. Below are four common misconceptions:

- Misconception 1: The Small Estate Affidavit can be used for any size estate.

- Misconception 2: All heirs can use the Small Estate Affidavit.

- Misconception 3: The Small Estate Affidavit eliminates all legal requirements.

- Misconception 4: The Small Estate Affidavit is a one-size-fits-all solution.

In reality, the Small Estate Affidavit is only applicable to estates with a total value of $75,000 or less, excluding certain types of property. This limit is crucial to understand, as exceeding it disqualifies the use of this form.

This form is intended for specific individuals, typically the surviving spouse or heirs. Only those who are entitled to inherit under Minnesota law can utilize the Small Estate Affidavit to claim the deceased’s assets.

While this form simplifies the process, it does not eliminate all legal obligations. Affidavit filers must still provide accurate information and may need to notify creditors or file tax returns, depending on the estate's circumstances.

Each estate is unique, and the Small Estate Affidavit may not be suitable for every situation. Factors such as the type of assets, debts, and family dynamics can affect whether this form is appropriate. Consulting with a legal professional can provide guidance tailored to individual circumstances.

Other Common Minnesota Templates

Vehicle Bill of Sale Mn - Completing this form can simplify the vehicle registration process with your state’s motor vehicle department.

Quick Claim Deeds Mn - This document is quicker and easier than a warranty deed.

To effectively navigate motor vehicle transactions in Alabama, it's important to understand the benefits of utilizing the Motor Vehicle Power of Attorney form for granting authority to another person. This form streamlines processes like vehicle registration or sale, ensuring that all actions are taken in accordance with Alabama laws.

Bill of Sale Atv - Establishes a clear agreement between buyer and seller.