Valid Transfer-on-Death Deed Form for the State of Minnesota

The Minnesota Transfer-on-Death Deed form serves as a valuable estate planning tool, allowing individuals to transfer real estate to beneficiaries without the complexities of probate. This form provides a straightforward method for property owners to designate who will receive their property upon their passing, ensuring a smoother transition and preserving the value of the estate. By filling out this deed, property owners can maintain control over their assets during their lifetime while also simplifying the transfer process for their loved ones after death. Importantly, the Transfer-on-Death Deed does not take effect until the property owner passes away, meaning that the owner can change their mind or revoke the deed at any time before that point. This flexibility, combined with the potential to avoid probate, makes it an appealing option for many. Understanding the requirements and implications of this deed is crucial for anyone considering it as part of their estate planning strategy.

Key takeaways

Filling out and using the Minnesota Transfer-on-Death Deed form can be a straightforward process, but it's essential to understand a few key points to ensure everything goes smoothly. Here are some important takeaways:

- Understand the Purpose: The Transfer-on-Death Deed allows property owners to transfer their real estate directly to beneficiaries upon their death, avoiding the probate process.

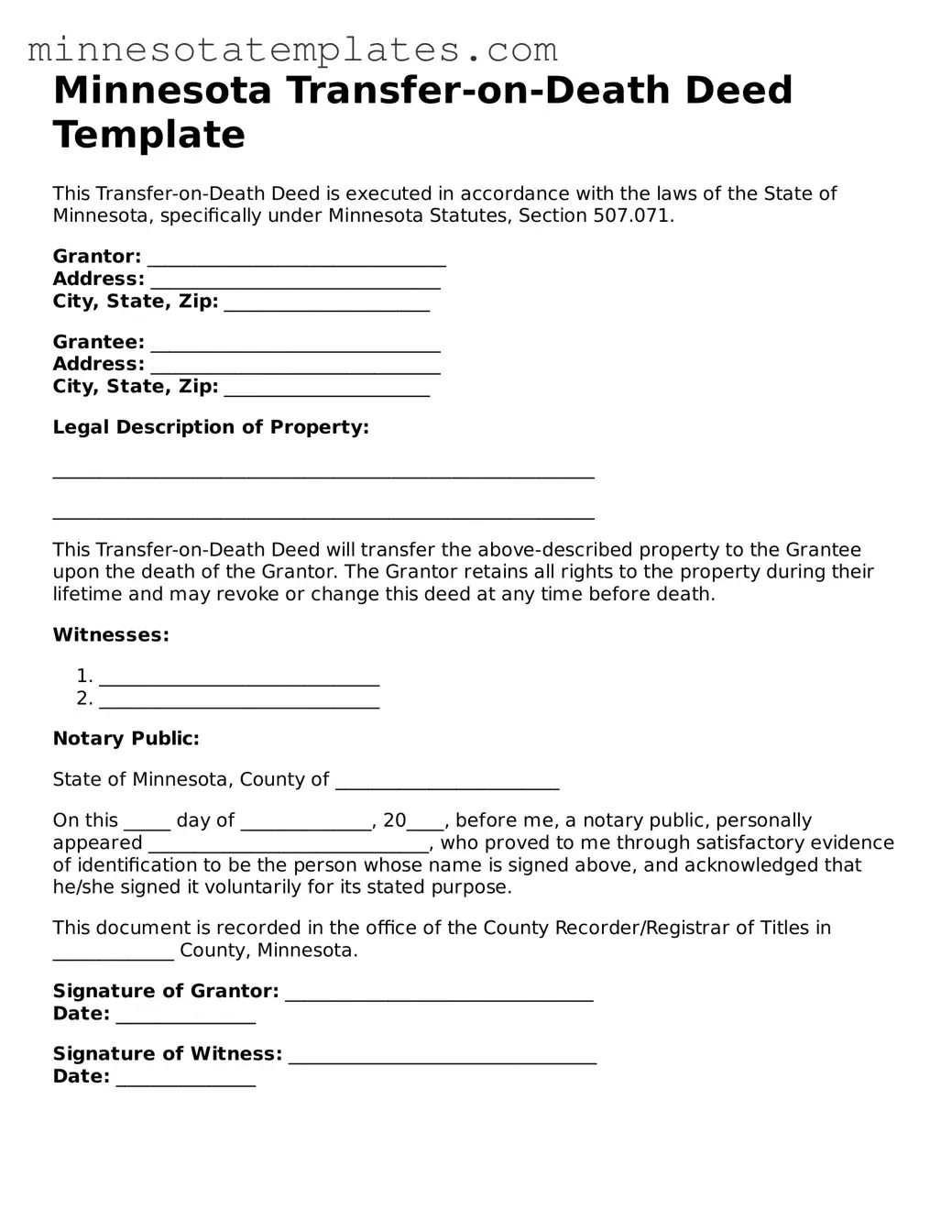

- Complete the Form Accurately: Make sure to fill out the form completely and correctly. Include the property description and the names of the beneficiaries clearly to avoid any confusion later.

- Sign and Notarize: The deed must be signed by the property owner and then notarized. This step is crucial, as a deed that is not properly signed and notarized may not be valid.

- File with the County: After completing the deed, it must be filed with the county recorder or registrar of titles where the property is located. This step officially records the transfer and makes it effective.

By keeping these points in mind, you can navigate the process of using a Transfer-on-Death Deed with confidence and ensure your wishes are honored in the future.

Misconceptions

The Minnesota Transfer-on-Death Deed (TOD) form can often be misunderstood. Here are five common misconceptions about this legal document:

- It transfers property immediately upon signing. Many people believe that once they sign the TOD deed, the property is transferred right away. In reality, the transfer only occurs upon the death of the property owner.

- It eliminates the need for a will. Some think that using a TOD deed means they do not need a will. However, a TOD deed only addresses the transfer of specific property and does not cover other assets or personal wishes that a will would manage.

- It is only for real estate. While the TOD deed is primarily used for real estate, it can also be used for certain other types of property, depending on state laws. This misconception limits its applicability.

- It cannot be revoked or changed. A common belief is that once a TOD deed is created, it cannot be altered. In fact, the property owner can revoke or change the deed at any time before their death.

- It avoids probate for all assets. Some assume that using a TOD deed means all their assets will bypass probate. This is incorrect. Only the property specified in the TOD deed avoids probate; other assets may still be subject to the probate process.

Understanding these misconceptions can help individuals make informed decisions regarding their estate planning in Minnesota.

Other Common Minnesota Templates

Form Ps2000 - This authorization can be a simple yet effective approach to managing vehicle responsibilities.

For anyone looking to navigate vehicle transactions in Alabama, understanding the Motor Vehicle Power of Attorney document is crucial. This form enables individuals to designate an agent to manage their vehicle-related affairs, ensuring a smooth and efficient process.

Does an Attorney Have to Prepare a Power of Attorney - By using this form, parents can provide peace of mind about their child's care.